- Liquidity Natural Gas Daily

- Posts

- Natural Gas Update 6-30-2025

Natural Gas Update 6-30-2025

Liquidity Energy, LLC

Overview

Natural Gas --NG is down 15.7 cents

NG futures are lower today after Friday's strong rally, as the weather does not seem hot enough to cause a major surge in demand like that seen this past week. Gas production remains strong.

LSEG said average gas output in the Lower 48 U.S. states rose to 105.6 BCF/d so far in June, up from 105.2 BCF/d in May. Back on June 10, LSEG had June output averaging 105.0 BCF/d.

Although above-normal temperatures are expected across the Lower 48 states through at least July 12, meteorologists say a return to last week’s peak heat is unlikely. (tradingview.com)

Total feedgas flow to US LNG export terminals are estimated down 0.501 BCF/d to 14.75 BCF/d today, Bloomberg shows, after rising to the highest since May 11 yesterday.

Friday's sharp rally looks to have been a function to some degree of short covering, given August open interest on the CME saw a decline of over 11,000 contracts as the contract became the spot futures.

The fall today in NG prices comes even as this week's storage build is seen shrinking the 5 year deficit after 10 weeks of larger-than-usual net injections. Early estimates seen for this week's EIA number are calling for a build of 49 to 53 BCF. The 5 year average build is 61 BCF.

CFTC data seen Friday showed money managers covered a very small amount of their net short position in the week ended Tuesday June 24. Buying of longs saw the net short total fall by 2,536 contracts to 60,725 contracts.

The Baker Hughes gas rig count saw a decline of 2 units in Friday's report.

TTF European futures prices have fallen today to their lowest spot price value since May 5th as Mideast tensions have eased. Today's fall comes after last week's most significant weekly decline in nearly two years. Prices fell by roughly 20% last week and have fallen 7 days in a row now. (Bloomberg) Also weighing on prices is a strong LNG import volume. They are currently running 41% above the five-year seasonal average, according to analysts at ANZ Research. (investing.com) European storage levels are healthy—57% full compared to an average of 66%. (WSJ). The pullback in futures prices comes even as much of Europe is in the midst of a strong heat wave. In the European natural gas market, money managers flipped to 18% net shorts from 9% net longs as of last Tuesday, according to data from Bridgeton Research Group LLC. (Bloomberg)

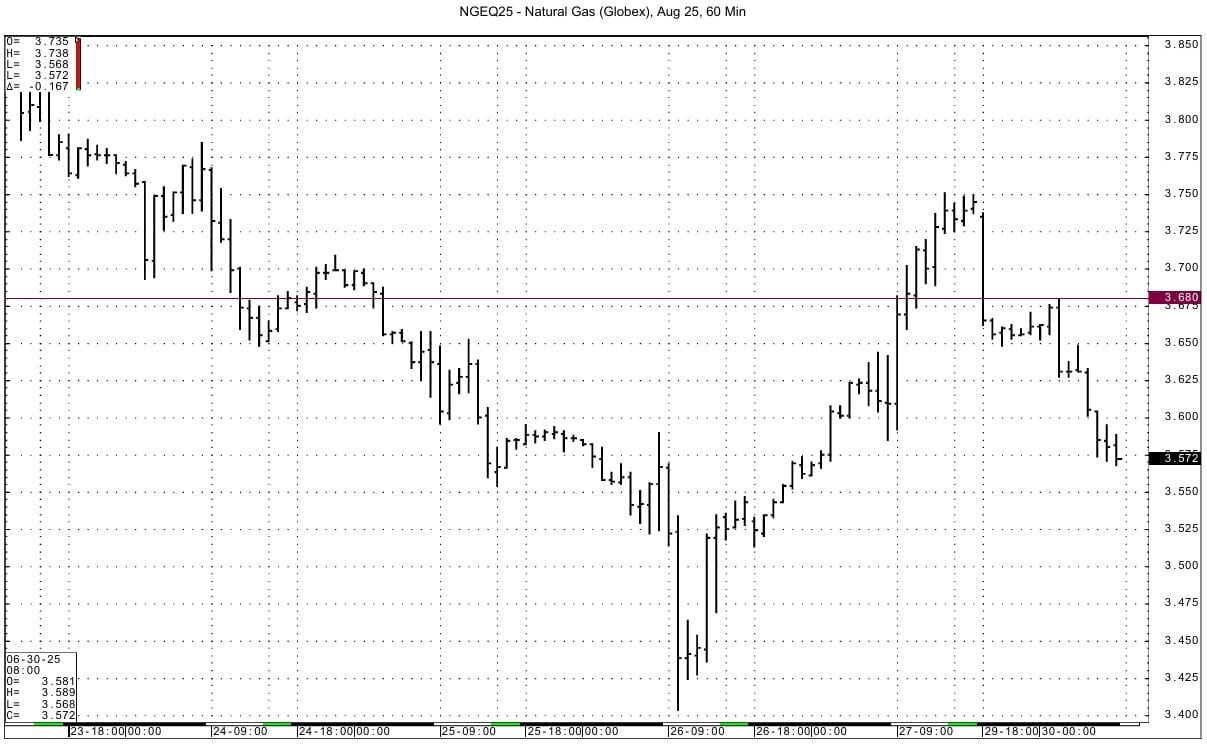

As per Reuters, some analysts have started to say the natural gas futures market may have already seen its highest price for the summer when it hit $4.15 on June 20 in anticipation of last week's heat wave. Technically today's NG futures prices are showing an inside day versus the price range seen Friday. Momentum basis the DC chart is trying to turn positive. Support for August futures is seen at 3.513-3.515 and then at 3.453-3.454. Resistance lies at 3.680-3.685 via the August 60 minute chart. Above that resistance is seen at 3.751-3.760.

Enjoyed this article?

Subscribe to never miss an issue. Daily updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply