- Liquidity Natural Gas Daily

- Posts

- Natural Gas Update December 1,2025

Natural Gas Update December 1,2025

Liquidity Energy, LLC

February 3, 2026

Overview

Natural Gas--NG is down 0.4 cents at $4.846

NG spot futures are lower now after having traded both higher and lower in today's session. We suspect that the market retreated overnight due to some profit taking after rising to a nearly 3 year high on a settlement basis Friday. Additionally, the weather forecast although cold in the near term is seen moderating in the second half of the 15 day period. Also, subdued prices in Asia and weaker pricing in Europe likely weighed on NG pricing.

NG futures have risen today to their best value since March 10th as weather demand in the next week was seen high, according to NatGasWeather. But, they see moderate demand in days 7 through 15. Chicago is expected to remain cold this week, but shift back toward normal temps next week. Celsius Energy adds that their GWDD calculations are calling for the period from Saturday Nov. 29 to this Friday Dec. 5 to show the most GWDD's in the past 6 years.

LNG feedgas volume continues to stay strong. Market News puts today's volume at what they say is a record at 18.94 BCF/d. Meanwhile, Bloomberg data shows today's U.S. gas production is running at 113.96 BCF/d, compared to the 30 day average of 111.7 BCF/d.

The TTF market in Europe has gapped lower over the weekend and has fallen to its lowest spot futures value since April 11, 2024. Prices have been pressured by warmer weather forecasts, in addition to high LNG imports and steady Norwegian gas supply. (Trading Economics/Investing.com) Today's TTF low price is Euro 27.75, which equates to $9.46/MMBtu. Technically, the contract continues to test the contract's lower bollinger band, as it has for the past week or more. Momentum is getting near oversold. One analyst, cited in Hellenic Shipping News commentary, says that hedge funds have "slipped" into a net short position in TTF futures last week for the first time since March of 2024. Reuters says that global LNG freight rates in the Atlantic have risen to their highest level year to date.

Asian LNG prices have fallen to an 8 week low on high inventories and "continued muted demand". The price for January deliveries into North East Asia have fallen to $10.90/MMBTU, from $11.66 last week. Weather has not been cold enough in the region to generate fresh buying. (Hellenic Shipping News) Pacific LNG freight rates are said to have risen to their highest level since December 2023 as per one analyst cited by Reuters.

On Friday, LSEG projected average gas demand in the Lower 48 states, including exports, at 140.6 BCF/d this week. This forecast was up 0.5 BCF/d from that seen Wednesday. Next week's demand is seen falling to 136.5 BCF/d.

U.S. gross natural gas production from the Lower 48 states in September fell to 122.17 BCF/d down slightly (-0.63 BCF/d) from August’s all-time high of 122.8 BCF/d, according to the EIA’s 914 production report released on Friday.

Early estimates seen for this week's EIA gas storage number are calling for a draw of 17.8 to 20 BCF. These compare to last year's draw of 26 BCF and the 5 year average draw of 43 BCF. The following 2 weeks data look to be setting up to reduce the surplus to the 5 year average by a considerable amount.

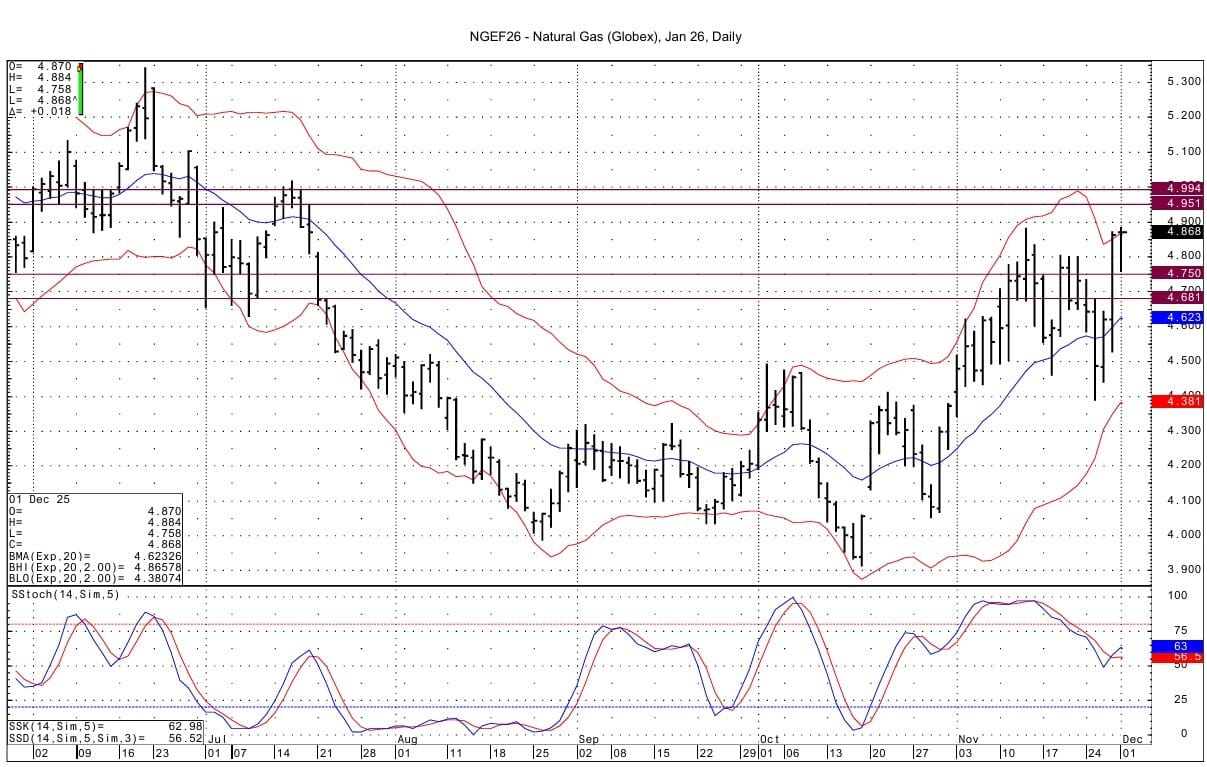

Technically NG has a few elements that we see cautioning the bulls: (1) there is now a double top from the prior session and today at 4.871-4.884 (2) there is a mean reversion setup from Friday's settlement over the DC chart's upper bollinger band and (3) the weekly chart's momentum is overbought.

The DC chart upper bollinger band lies at 4.774. Resistance above comes in at 4.901 from the January daily chart high of mid-November. Above that resistance is seen at 4.942-4.951 and then at 4.990-4.994. Support lies at 4.750-4.756, which was almost tested with the overnight low of 4.758. Below that support comes in at 4.674-4.681. Momentum basis the DC chart remains positive.

Enjoyed this article?

Subscribe to never miss an issue. Daily updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Business news worth its weight in gold

You know what’s rarer than gold? Business news that’s actually enjoyable.

That’s what Morning Brew delivers every day — stories as valuable as your time. Each edition breaks down the most relevant business, finance, and world headlines into sharp, engaging insights you’ll actually understand — and feel confident talking about.

It’s quick. It’s witty. And unlike most news, it’ll never bore you to tears. Start your mornings smarter and join over 4 million people reading Morning Brew for free.

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply