- Liquidity Natural Gas Daily

- Posts

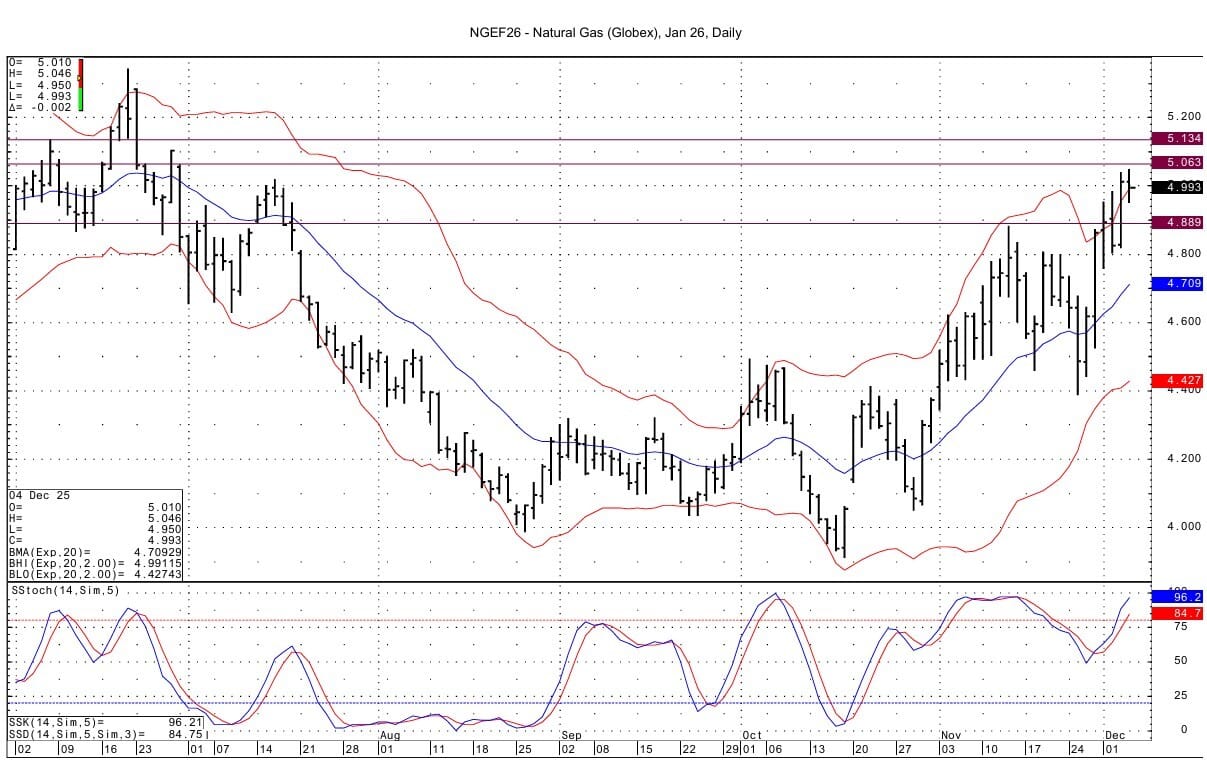

- Natural Gas Update December 4, 2025

Natural Gas Update December 4, 2025

Liquidity Energy, LLC

February 3, 2026

Overview

Natural Gas---NG is down 4.9 cents at $4.946

Natural gas futures are lower now after climbing overnight to a fresh multi year high as cold weather forecasts continued to boost sentiment. But, some question whether the storage surplus to the 5 year average, which will widen today, is a possible headwind for the contract. Technically the contract is getting overbought.

The EIA storage data is seen as a draw of 14 to 18 BCF as per WSJ and Reuters surveys. This compares to last year's draw of 26 BCF and the 5 year average draw of 43 BCF. "Forecasts for the coldest December since 2010 may tip storage into a deficit by Christmas," trading firm EBW Analytics wrote in a note to clients. (WSJ)

Demand for heating is likely to remain strong "as a frosty weather system tracks across the northern" U.S., NatGasWeather wrote Wednesday.

Open interest in NG futures on the CME rose by 24,205 contracts in Wednesday's trading. The whole strip from March 2026 to April 2027 saw increases. We see this as mostly new longs being established.

The TTF European gas spot futures fell today to their lowest value since April 10,2024. Since January, European gas prices are down more than 45%. As of November 30, European inventories were 75% full, roughly 10% below the five-year average. In Germany, Europe’s largest gas market, storage levels are even weaker at just 67%, more than 20% below seasonal norms. With Asian demand relatively weak and US export capacity strong, Europe has become the primary destination for American LNG. The strong inflow of LNG into Europe is seen as the main driver to falling prices. Goldman Sachs expects rising global supply — particularly from the US — to lift European storage levels and gradually push TTF and prices lower, forecasting TTF at €29/MWh in 2026 and €20/MWh in 2027. Goldman adds that by 2028–2029, storage congestion in Northwest Europe could drive TTF as low as €12/MWh, closing the US LNG export arbitrage and forcing cancellations of American cargoes. Today, TTF spot futures are trading Euro/Mwh 27.420, which equates to $9.38/MMBtu. The contract has been sliding along the lower bollinger band for the past 10 sessions. Momentum is near oversold. Support is seen at 27.165 and then at 26.160 Euro/ Mwh from data from April, 2024. The best upside resistance we see lies at Euro/Mwh 30.255.

Technically the NG futures market again has a mean reversion setup from Wednesday's close over the DC chart upper bollinger band. That band lies today at $4.975. There is currently a double top from yesterday/today at $5.039 / 5.046. Resistance above that comes in at 5.061-5.063 and then at 5.131-5.134. Support lies at 4.884-4.889 and then at 4.819.

Enjoyed this article?

Subscribe to never miss an issue. Daily updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

The headlines that actually moves markets

Tired of missing the trades that actually move markets?

Every weekday, you’ll get a 5-minute Elite Trade Club newsletter covering the top stories, market-moving headlines, and the hottest stocks — delivered before the opening bell.

Whether you’re a casual trader or a serious investor, it’s everything you need to know before making your next move.

Join 200K+ traders who read our 5-minute premarket report to see which stocks are setting up for the day, what news is breaking, and where the smart money’s moving.

By joining, you’ll receive Elite Trade Club emails and select partner insights. See Privacy Policy.

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply