- Liquidity Natural Gas Daily

- Posts

- Natural Gas Update July 1, 2025

Natural Gas Update July 1, 2025

Liquidity Energy, LLC

July 1,2025

Overview

Natural Gas--NG is down 7.3 cents

The slide in NG prices continues as production is strong and weather demand is not seen nearly equaling that seen last week. A comment seen re the current weather versus that of last week says : " demand may wither with the hottest weather of summer potentially booked, and be met in part by wind and solar."

Natural gas production hit 107.4 BCF/d on Sunday and Monday. (NGI/Bloomberg) LSEG had the June average output at 105.9 BCF/d as per Monday data. May's average output was 105.2 BCF/d.

Forecaster Atmospheric G2 said Monday that forecasts shifted cooler across the central and eastern US for July 10-14. (Barchart.com) Additionally, demand forecasts as per LSEG were dialed back. LSEG estimated 199 total degree days (TDDs) over the next two weeks, compared with 234 estimated on Friday. The normal for this time of year is 170 TDDs. LSEG forecasts NG demand this week at 105.4 BCF/d, dropping to 105.0 BCF/d next week. Those forecasts are down a total of 1.6 BCF/d from those seen Friday.

One comment heard yesterday regarding NG futures prices was : "the market is violently range bound." The pullback the last 24 hours from Friday's value underscores that. The prior 2 days' highs were 3.738/3.751. And as we suggested last Monday, the $4.00 level seems unsustainable. On the down side, the area near $3.10 provides support with the notion that demand will be ample to keep prices above that. Adequate weather demand near the 10 year average and the return of LNG plants from maintenance should keep a floor underneath current pricing seems to be the prevailing sentiment.

In Natural Gas options (LN contract), the October November 1 month CSO call spread traded. The buyer of the -25 cents call sold twice as many of the -15 cent calls for a cost of 0.9 cents. The volume of the Oct/Nov CSO traded was 1,000 by 2,000 contracts. Additionally the Sept/Nov two month CSO call spread traded 1,250 contracts, with a buyer of the -25 cent call selling the -15 cent call against that for a cost of 1.4 cents. The trade was a liquidation of open positons with the entire September/November CSO call open interest now at zero.

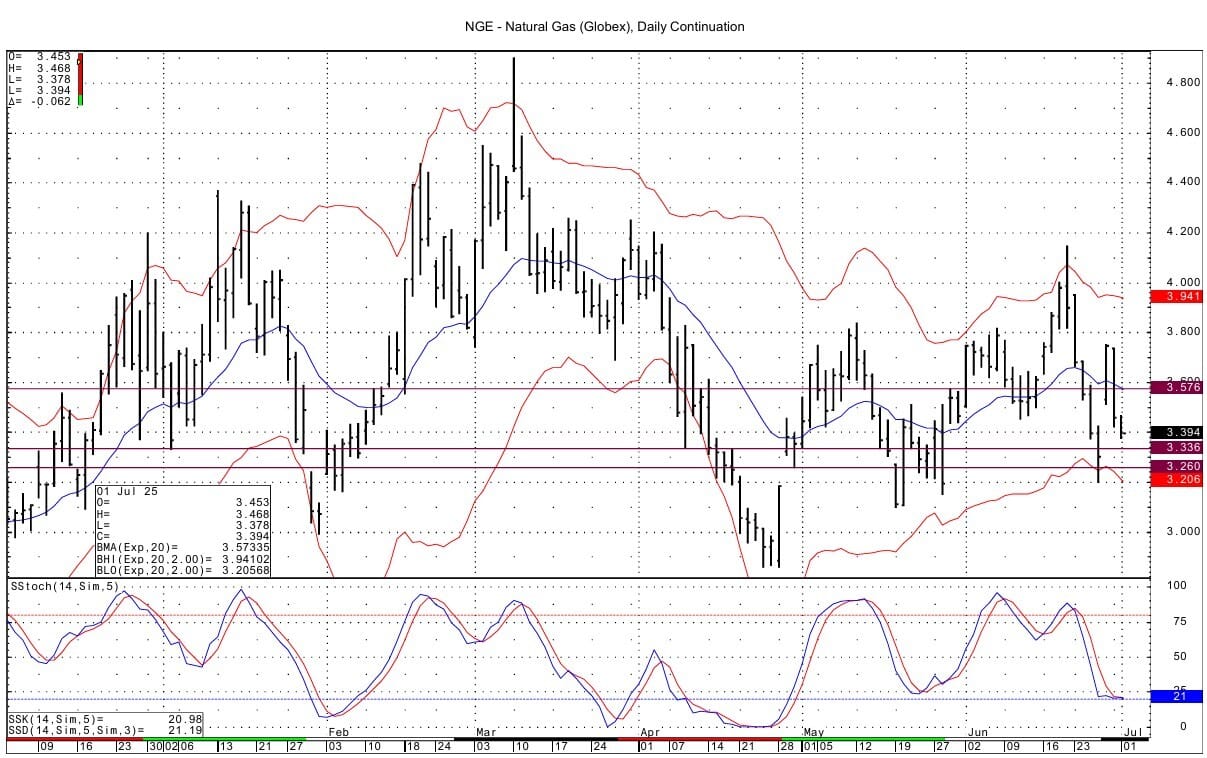

In the NG futures, the DC chart gap from 3.513 down to 3.425 that was created last week when August became the spot contract has been filled. The August daily chart shows the lower bollinger band having been tested Monday. That band today intersects at $3.361. The August daily chart shows that today's price is the lowest seen since December 20, 2024. The DC chart momentum is trying to stay positive. Support is seen at 3.335-3.340 and then at 3.260-3.264. Resistance is seen at the overnight high at 3.466-3.468 and then at 3.576.

Enjoyed this article?

Subscribe to never miss an issue. Daily updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply