- Liquidity Natural Gas Daily

- Posts

- Natural Gas Update July 10,2025

Natural Gas Update July 10,2025

Liquidity Energy, LLC

{current_date_full}}

Overview

Natural Gas --NG is up 4.7 cents

NG spot futures are higher today after settling yesterday at the lowest level since May 28. Today's price rise was seen due to stronger feed gas volume to LNG export plants. Yesterday's fall in prices was due to a cooler weather forecast, worries over rising storage and a weaker cash market.

Total feedgas flows to U.S. LNG export terminals are up 0.530 BCF/d on the day at 15.54 BCF/d today, Bloomberg shows, compared to the 30-day average of 14.51 BCF/d. The uptick is driven by higher feedgas deliveries to Corpus Christ. Flows into the facility had been restricted since Saturday due to pipeline maintenance. Reuters reporting shows the July feedgas volume to be 15.6 BCF/d, up from 14.3 BCF/d seen in June and 15.0 BCF/d seen in May.

The EIA gas storage number due out today is seen as a build of 58 BCF as per the WSJ survey. This compares to last year's build of 61 BCF and the 5 year average build of 53 BCF.

Forecaster Vaisala said Wednesday that forecasts shifted cooler in the Midwest for July 14-18 and weather outlooks shifted cooler for the eastern half of the US for July 19-23. (Barchart)

The August LN options open interest rose quite a bit as per CME data from Wednesday's trading. The $3.50 strike was one of those that rose. One trade saw the $3.50 call against selling of twice as many of the $3.75 calls for a cost of 1.2 cents to the $3.50 call buyer. The $3.50/$3.75 call spread went one for one at a cost of 3.35 cents. Additionally, in the LN options on the CME, 3,000 contracts of the October January $-1.00 call were sold against buying of the $-1.50 put at a cost of 4.1 cents to the put buyer. The October January spread settled Wednesday at $-1.336. And in the October November one month calendar spread put options, the $-0.50 put was purchased against selling of the $-0.75 put at a cost of 4.0 cents. Open interest data from the CME suggests that the $-.50 put was bought to close out a position, while the $-0.75 put portion of the trade was an initiation of the position. The October November spread settled at -41.5 cents Wednesday.

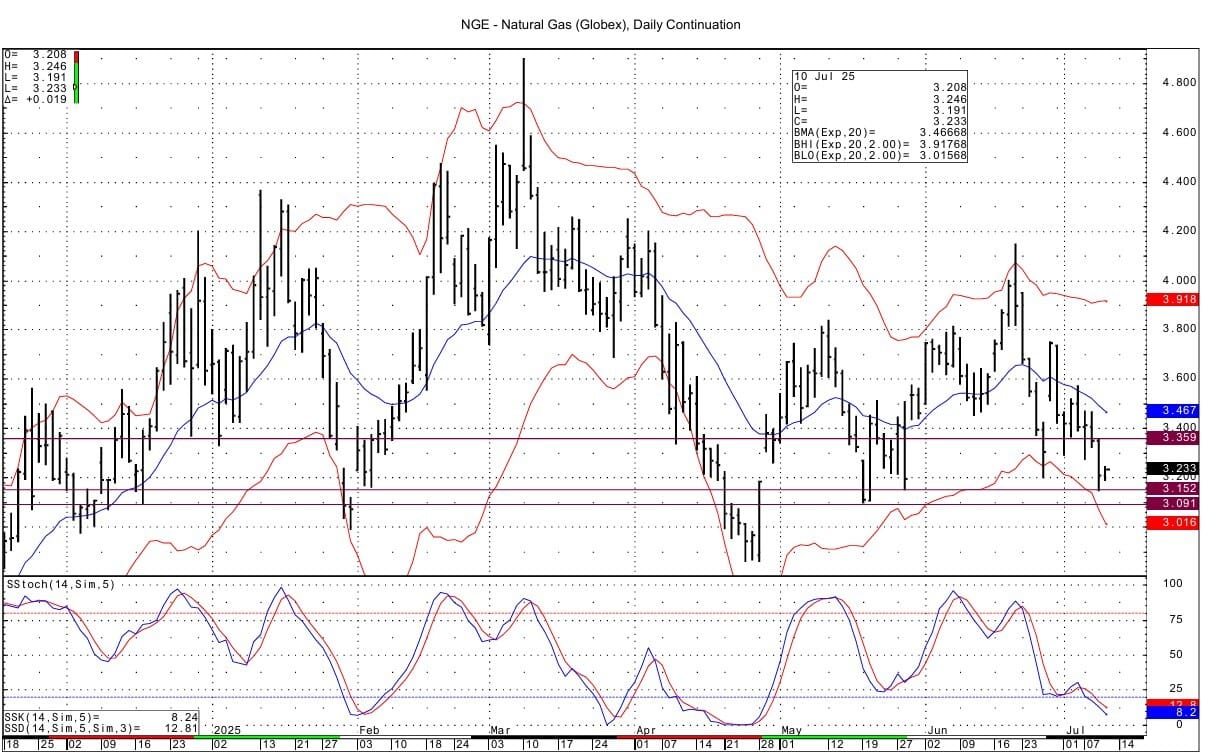

Technically NG spot futures have negative momentum, although that downward momentum seems to be slowing. Support at 3.145-3.152 was tested Wednesday with the low of 3.149. Below that support is seen at 3.091-3.098. Resistance lies above at 3.350-3.359.

Enjoyed this article?

Subscribe to never miss an issue. Daily updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

This Tiny Hearing Aid Is Changing Lives—And It’s Under $100

Big companies charge THOUSANDS for hearing aids—but guess what? You don’t have to pay that much.

Oricle Hearing gives you crystal-clear sound, wireless charging, and all-day battery life for under $100. No doctor visits, no crazy prices—just amazing hearing at an unbeatable deal.

Over 150,000 happy customers are already loving their new way of hearing. Don’t let overpriced hearing aids hold you back—order yours today.

Reply