- Liquidity Natural Gas Daily

- Posts

- Natural Gas Update July 11,2025

Natural Gas Update July 11,2025

Liquidity Energy, LLC

Overview

Natural Gas-- NG is up 3.6 cents

NG futures are higher supported the last 24 hours by several factors: a "benign" EIA storage number, higher feed gas volume to LNG plants, and a stronger demand forecast. Next day cash prices are firmer today as well.

Henry Hub next day cash is quoted 3.200/3.225 versus August NG futures printing 3.364, thus keeping the cash versus futures differential at the 15 cent area we have seen in recent days. Yesterday, the HH cash was seen at 3.100-3.130.

The EIA gas storage build seen Thursday was 53 BCF, which was seen as bullish as it was 5-6 BCF less than forecast. Yet, the 1,233 BCF placed into storage since the start of the injection season is the second-largest amount since 2010, as per one analyst. (WSJ) Total storage rose to 3.006 TCF, which is +173BCF/+6.11% versus the 5 year average, but -184 BCF/-5.77% versus last year.

The average amount of gas flowing to the eight big U.S. LNG export plants rose to 15.6 BCF/d so far in July as liquefaction units at some plants slowly exited maintenance reductions and unexpected outages. July's volume is up from the volume of 14.3 BCF/d seen in June. And Reuters reports that on a daily basis, LNG export feedgas was on track to rise to a 10-week high of 16.0 BCF/d on Thursday with flows to U.S. energy company Cheniere Energy’s 3.9-BCF/d Corpus Christi plant in operation and under construction in Texas expected to rise from 1.5 BCF/d on Wednesday to 2.2 BCF/d on Thursday, according to LSEG data.

With hotter weather expected, LSEG forecast average gas demand in the Lower 48, including exports, would rise from 107.3 BCF/d this week to 108.8 BCF/d next week. These forecasts were up 1.2 BCF/d versus those seen Wednesday.

There were a slew of NG/LN options trades seen on the CME Thursday. The October January spread fence traded again. The -$1.00 call was sold against which the -$1.50 put was purchased at a cost of cents to the put buyer of 4.2 cents. The same trade was executed Wednesday at a cost of 4.1 cents to the put buyer. Additionally in the October January calendar spread options, the -$1.25 / -$1.00 call spread traded in a 1x2 ratio with the buyer of the -$1.25 call paying 3.2 cents. The October $3.25 / $2.50 put spread traded in a 1x2 ratio with a cost of 15.6 cents to the $3.25 put buyer --with delta October futures bought at $3.40.

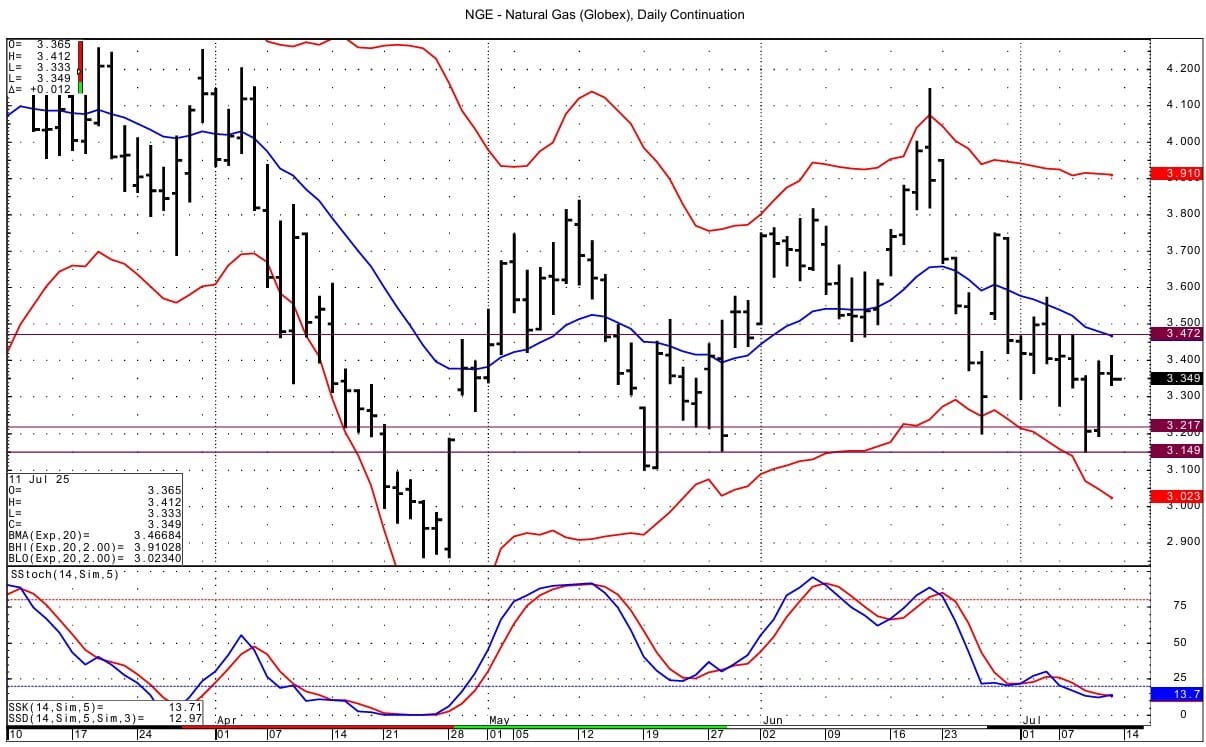

Technically momentum for the NG futures basis the DC chart is trying to turn upward. Support is seen at 3.272-3.275 via the August 60 minute chart. Below that support lies at 3.214-3.217. Resistance at the 3.350 area has been pierced with next resistance above seen at the highs from Monday/Tuesday of this week at 3.469-3.472.

Enjoyed this article?

Subscribe to never miss an issue. Daily updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply