- Liquidity Natural Gas Daily

- Posts

- Natural Gas Update July 14,2025

Natural Gas Update July 14,2025

Liquidity Energy, LLC

Overview

Natural Gas--NG is up 10.7 cents

NG spot futures are up strongly on a hotter forecast for the end of the month and the strong LNG feed gas volume seen of late.

Celsius Energy reports that over the weekend, weather models trended hotter, especially for the last 10 days of the month. 14-day accumulated Gas-Weighted Degree Days (GWDDs) for July 14-27 are back at 5 year highs for the period, they add.

Saturday's LNG feedgas demand rose to 16.4 BCF/d, the highest since April 14 and up an impressive +5.2 BCF/d vs last year, countering gains in production. Both Corpus Christi & Plaquemines are right at record highs. (Celsius Energy) July feed gas volume has averaged 15.7 BCF/d, up from June's volume of 14.3 BCF/d. (Reuters)

Early estimates for the EIA gas storage data due this week are calling for a build of 47.5 to 49 BCF. This compares to last year's +18 BCF build and the 5 year average build of 41 BCF.

In Asia, August JKM prices increased by 25.6 cents/MMBtu week over week to $12.758/MMBtu on July 11, supported by strong demand due to heatwaves in North Asia and the closure of the arbitrage window. While Asian traders are wrapping up August trades, the September market may see spillover demand from August, traders said. The traders said the supply is limited because the arbitrage window from the US remains shut. US cargoes might start arriving in September due to higher Asian prices, according to the traders. China remained quiet in the spot market because the current spot prices of $12/MMBtu were higher than domestic prices. (Platts) “An increase in spot purchases from buyers such as Japan and South Korea have been triggered by declining inventories,” analysts at ANZ Research say. “LNG inventories held by Japanese utilities slid to their lowest in almost two months amid strong power consumption.” (WSJ)

Strength in Asia is supporting European LNG/gas prices as the 2 regions compete for supply, as per Bloomberg commentary. Additionally, European natural-gas prices have risen in early trade as higher temperatures boost demand for cooling and traders grow wary of potential U.S. sanctions on Russia. Potential sanctions could restrict Russian LNG flows to Asia, tightening global supplies. (WSJ) Technically, the TTF futures price has been in a stepladder pattern for the past 6 sessions. There is a gap above the market from 37.100 to 40.200. Currently, TTF spot futures are trading near Euro 36/mwh. Support for the spot contract is seen just above 33 Euros.

The Baker Hughes gas rig count issued Friday was unchanged.

CFTC data seen Friday for the week ended Tuesday July 8 showed money managers added longs and covered some shorts thus reducing their net shorts by 4,504 contracts to a total net short position of 47,125 contracts.

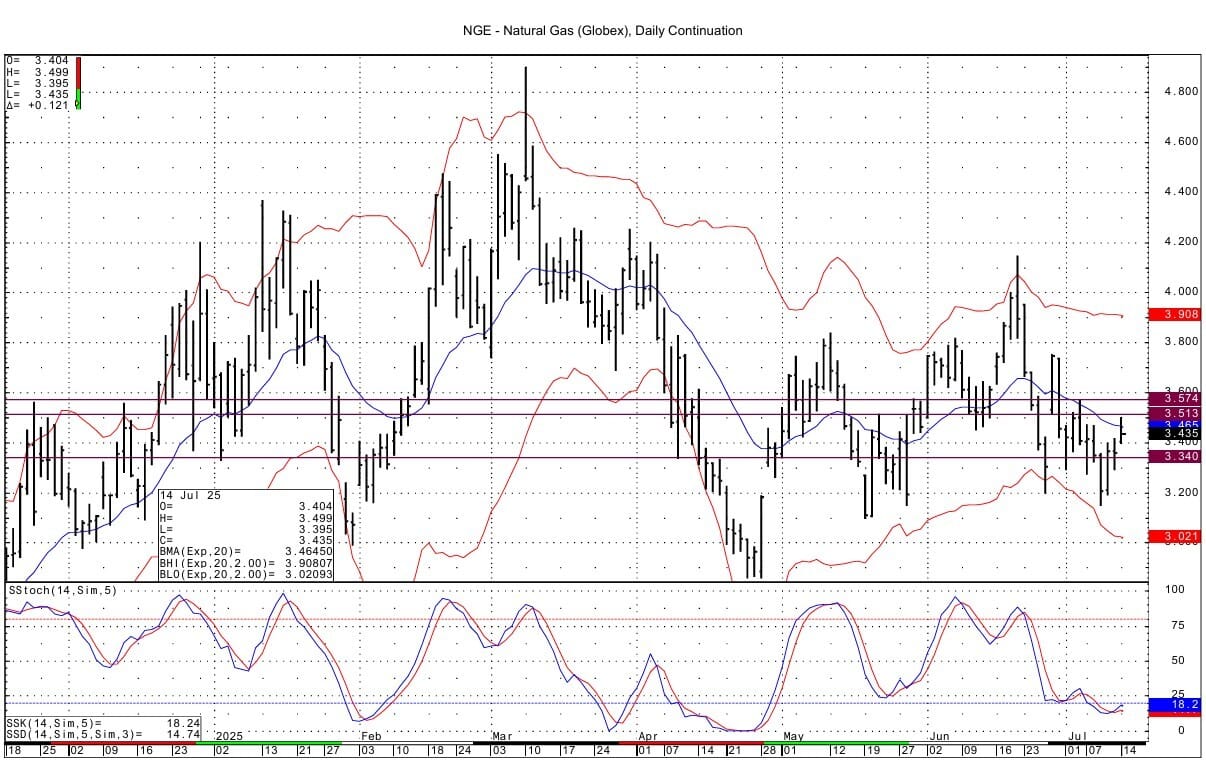

Technically NG has positive momentum basis the DC chart and a stepladder up look from the past 4 sessions. Upside resistance lies at 3.511-3.513 and then at 3.574-3.576. Support is seen at 3.335-3.340.

Enjoyed this article?

Subscribe to never miss an issue. Daily updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Finally, a powerful CRM—made simple.

Attio is the AI-native CRM built to scale your company from seed stage to category leader. Powerful, flexible, and intuitive to use, Attio is the CRM for the next-generation of teams.

Sync your email and calendar, and Attio instantly builds your CRM—enriching every company, contact, and interaction with actionable insights in seconds.

With Attio, AI isn’t just a feature—it’s the foundation.

Instantly find and route leads with research agents

Get real-time AI insights during customer conversations

Build AI automations for your most complex workflows

Join fast growing teams like Flatfile, Replicate, Modal, and more.

Reply