- Liquidity Natural Gas Daily

- Posts

- Natural Gas Update July 15,2025

Natural Gas Update July 15,2025

Liquidity Energy, LLC

Overview

Natural Gas--NG is down 3.3 cents

NG is lower on the back of continued strong production and the prospect for weaker demand. Bloomberg data indicates a slight drop in feed gas volume today.

A tropical disturbance heading into the Gulf of Mexico may disrupt some LNG export gas volume. Total feed gas flows to US LNG export terminals are down 0.41 BCF/d on the day at 15.26 BCF/d today, Bloomberg shows. This compares to the 30-day average of 16.61 BCF/d, as per Bloomberg data. The drop comes from lower flows to Corpus Christi. Feed gas volume to the 8 major LNG export plants rose on Monday to a 3 month high of 16.6 BCF/d, as per Reuters reporting. July volume has averaged 15.8 BCF/d, up from June's volume of 14.3 BCF/d, as per Reuters.

LSEG on Monday forecast average gas demand in the Lower 48, including exports, would slide from 107.8 BCF/d this week to 106.8 BCF/d next week. These forecasts are down a total of 1.1 BCF/d from those seen Friday.

Production remains "strong' with July average production of 106.8 BCF/d, up from June's record of 106.4 BCF/d.

The Desk's EOS survey for end October natural gas is calling for storage to be at 3.915 TCF, which aligns with the EIA's STEO estimate seen a week ago of 3.910 TCF.

In Monday's activity in NG/LN options on the CME, there was a notable open interest increase in the August $3.70 and $3.90 call strikes. This was due to trades of 5,000 contracts in the $3.70/$3.90 call spread between 30 and 35 cents.

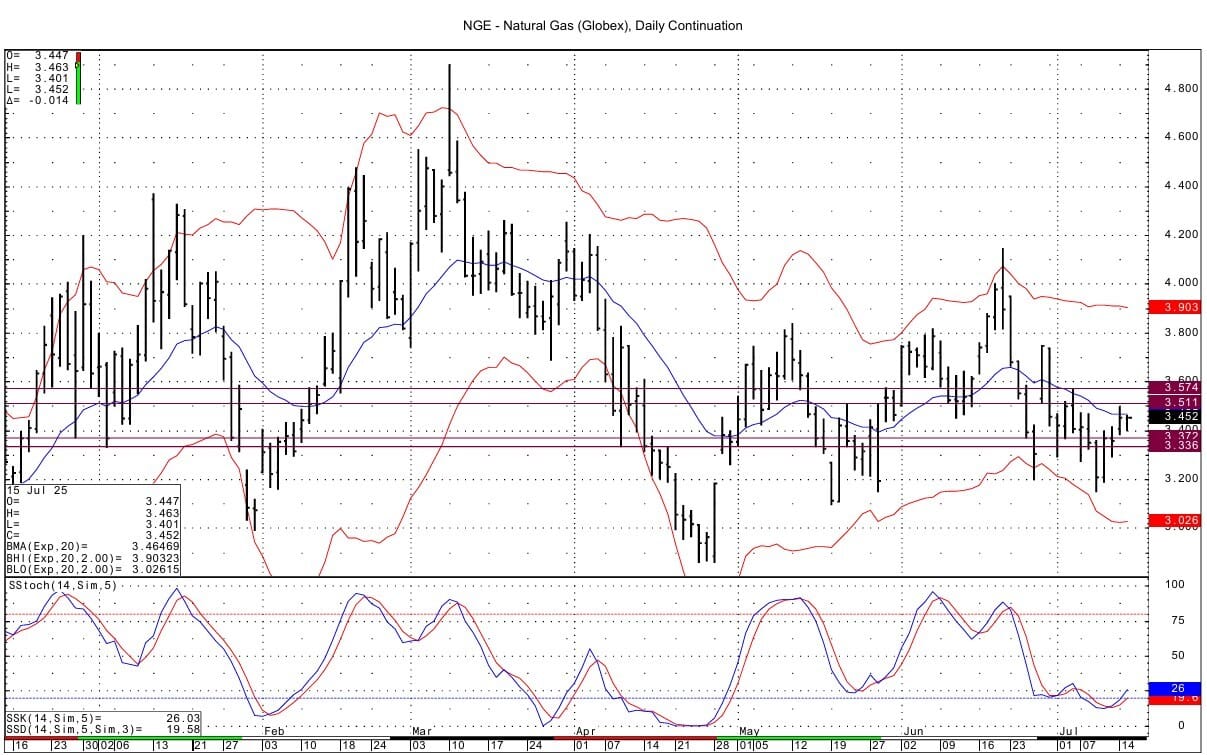

Technically NG has positive momentum basis the DC chart as the contract is currently having an inside trading day versus yesterday's price range. Support for the spot futures is seen at 3.366-3.372 and then at 3.335-3.340. Resistance lies at 3.511-3.513 and then at 3.574-3.576.

Enjoyed this article?

Subscribe to never miss an issue. Daily updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

This Tiny Hearing Aid Is Changing Lives—And It’s Under $100

Big companies charge THOUSANDS for hearing aids—but guess what? You don’t have to pay that much.

Oricle Hearing gives you crystal-clear sound, wireless charging, and all-day battery life for under $100. No doctor visits, no crazy prices—just amazing hearing at an unbeatable deal.

Over 150,000 happy customers are already loving their new way of hearing. Don’t let overpriced hearing aids hold you back—order yours today.

Reply