- Liquidity Natural Gas Daily

- Posts

- Natural Gas Update July 2,2025

Natural Gas Update July 2,2025

Liquidity Energy, LLC

February 3, 2026

Overview

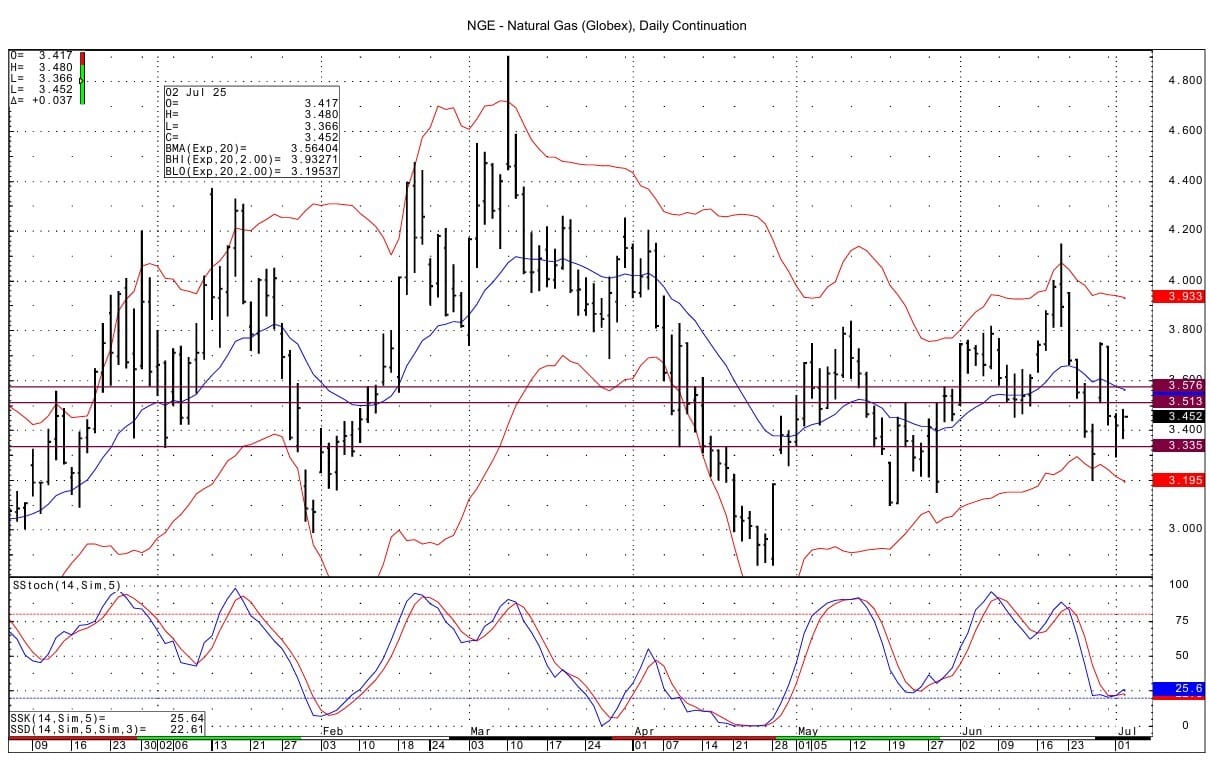

Natural Gas--NG is up 3.5 cents

NG futures are higher as the rally has likely been fueled by an increase in demand due to strong power generation burns and an increase in feed gas demand volumes to LNG plants.

Based on electrical grid data, the natural gas power burn demand has eclipsed year-ago levels each of the past eight days and, per Tuesday’s intraday numbers, was on track for a ninth straight near 2025 highs just below 50 BCF/d. This was seen as being due to weaker wind generation, hot temperatures along the populous Eastern Seaboard and some coal back to gas switching, as per Celsius Energy.

Tuesday’s LNG feedgas demand rose to 15.6 BCF/d, up 3.2 BCF/day versus last year. The gains come courtesy of volumes to Corpus Christi jumping to a new all-time high of 2.59 BCF/d. (Celsius Energy) June feed gas demand averaged 14.4 BCF/d as per LSEG data.

Notable to us was the fact that on Tuesday, as the August NG futures fell to their lowest level since December 18 on the daily chart basis, the October January spread actually narrowed during much of the day. We believe that this was due to 1) possibly some profit taking on the spread --but more likely (2) the winter strip was being sold as concerns over winter supply are possibly abating. Evidence of the winter strip being sold was the fact that during much of the trading session. the winter strip of the NG curve was down more than any other months trading. In early trading this morning, we are seeing a similar pattern, as the spot August futures are up 4.5 cents at this writing, while the November through March strip is up 2.2 to 3.4 cents.

The rally the past 24 hours has seen momentum basis the DC chart turn positive. Resistance lies at 3.513-3.515 and then at 3.576. Support is seen at 3.335-3.340.

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply