- Liquidity Natural Gas Daily

- Posts

- Natural Gas Update July 21,2025

Natural Gas Update July 21,2025

Liquidity Energy, LLC

Overview

Natural Gas--NG is down 15.7 cents

NG spot futures have gapped lower as production is robust--in fact near a record--and the weather forecast put out over the weekend is said to have cooled somewhat.

While the near-term temperature outlook remains hotter-than-normal, the forecast has cooled somewhat over the weekend, especially for the first week of August. (Celsius Energy) NatGasweather mentions that cooling of the outlook is not surprising since the 15 day CDD total is the highest in the past 50 years. NatGasweather adds that this week's U.S. demand is still set to be "very strong". They added that wind generation is set to be light in the 6-15 day forecast period. A bulge in the jet stream is developing as high pressure builds could create a persistent heat dome lingering well into August, an AccuWeather Meteorologist said. The Kansas City, Missouri, area, which hasn't hit 100 degrees in two years, could reach the figure multiple times this week, he said. Dallas could see 100 degrees for the first time in 2025. (USA Today)

The Baker Hughes gas rig count issued Friday showed an increase of 9 units. The Haynesville basin added 3 rigs. The Baker Hughes U.S. gas rig count stands at 117 units, up 16 rigs, or 15.8% on the year. The total gas rig count is now the highest since March 2024. (Market News) NG futures fell Friday to a fresh low for the session after the rig count was issued. And the reaction further along the curve was more negative. August and September 2025 futures settled up 2.3/2.2 cents respectively, while the strip from December 2025 to November 2026 saw settlements of -2.1 to -3.4 cents The front end was likely being helped by the impending heat in the U.S. this coming week. The next day cash versus spot futures differential narrowed Friday to 6 to 8 cents from a differential seen earlier in the week of 20 cents.

U.S. domestic natural gas production was estimated up to around 108.9 BCF/d over the weekend, according to Bloomberg data, compared to the previous 30-day average of 107.4 BCF/d. Celsius Energy adds that production near 108 BCF/d is up about 6 BCF/d versus a year ago level.

CFTC data seen Friday showed money managers lowered their net short positioning in NG futures/options on the CME in the week ended Tuesday July 15. Mostly longs were added. The net short total fell by 27,600 contracts to 19,525 contracts. Celsius Energy says that money managers' long positioning have now increased by more than 50% since mid-May to 211,321 contracts, the highest since March 11. The ratio of longs-to-shorts is now 4% higher than this time last year.

A Reuters analyst detailed how Asian LNG imports have been sluggish the past 2 months, mostly due to lower Chinese demand. The soft July imports continue a trend this year of declining LNG arrivals in Asia, with the first seven months of 2025 down 6.3% from the same period last year. In contrast to Asia's declining LNG imports, Europe's have been trending higher, with the first seven months seeing arrivals up 24% from the same period in 2024, according to Kpler data. European LNG import demand has kept global prices elevated, leading to lower demand from price-sensitive buyers in Asia, especially China. In Asia, the spot LNG price dropped to $12.33/mmBtu in the week to July 14 from $12.90 the prior week. But for Chinese buyers, a spot price of above $10-$11/mmBtu is believed to make LNG imports uncompetitive against domestic output and pipeline supplies from Russia and Central Asia.

The large amount of LNG imports into Europe has contributed to ample supply that has seen TTF futures prices fall to a 2 week low. Today's low is Euro 33.400/Mwh, equal to $11.40/MMbtu.

Early estimates for the NG IEA gas storage data for this week's number are calling for a build from +28.7 to +39 BCF. Last year's build was 20 BCF and the 5 year average build is 30 BCF.

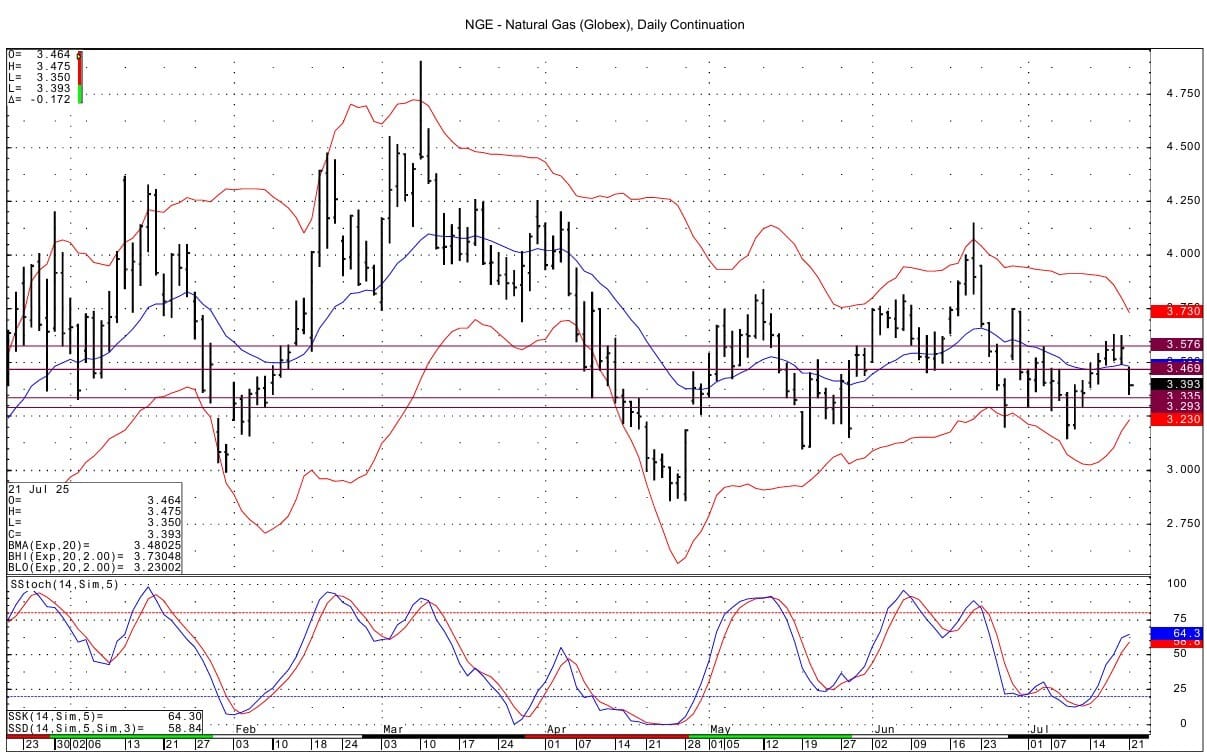

Momentum remains positive for the NG basis the DC chart, despite today's selloff. Support for the spot futures is seen at 3.335-3.336 and then at 3.293. Resistance lies at 3.469-3.475 and then at 3.574-3.576.

Enjoyed this article?

Subscribe to never miss an issue. Daily updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply