- Liquidity Natural Gas Daily

- Posts

- Natural Gas Update July 23,2025

Natural Gas Update July 23,2025

Liquidity Energy, LLC

Overview

Natural Gas--August NG is down 4.3 cents

NG is lower as the narrative remains one of weaker demand forthcoming versus the current heatwave amid robust natural gas production. But,as one analyst noted:" The January contract is essentially already testing support, sitting at its lowest level since late spring, That could be a buying signal for some physical buyers hedging winter exposure such as utilities or larger retail suppliers."

Forecaster Vaisala on Tuesday said forecasts shifted cooler for the Midwest in the latter half of the July 27-31 period, and milder conditions are expected to continue for August 1-5 over much of the US. (Barchart) Celsius Energy is calling for 191 GWDDs for the period of July 23 to August 5, which is down 15 GWDD from last week's forecast.

U.S. domestic natural gas production was estimated well above year ago levels at 108.2 BCF/d yesterday, according to Bloomberg data, and compared to the previous 30-day average of 107.4 BCF/d. Earlier in the week, Celsius Energy had pointed out how the 108 BCF/d current production level was up about 6 BCF/d versus a year ago.

European gas storage is up to 65.13% full on July 20 compared to the previous five-year average of 73.6% full, according to Gas Infrastructure Europe. Net injection rates are holding above normal. A recovery in Norwegian gas flows to Europe following an unplanned outage last week has eased supply concerns. ING and Societe Generale add that European gas prices will need to remain well supported through the year to ensure enough LNG is brought into the region ahead of the 2025/26 winter.

Following an expected slowdown in 2025, global natural gas demand growth is forecast to accelerate in 2026, sending total demand to a new all-time high, the IEA said in its latest quarterly Gas Market Report. But, overall, global natural gas demand growth is forecast to slow to about 1.3% in 2025 from 2.8% in 2024. But, global growth in 2026 is seen rising to +2.0%. Asia’s gas demand is expected to rise by more than 4% in 2026, accounting for around half of global gas demand growth. “Consequently, the region’s LNG imports are projected to increase by 10% in 2026 following an expected decline in 2025,” IEA said. But, in 2026, LNG supply is set to rise by 7%, or 40 bcm—its largest increase since 2019—as new projects come online in the US, Canada, and Qatar. Market fundamentals remained tight in first-half 2025 due to a combination of lower Russian piped gas exports to the European Union, slower growth in LNG output, and higher storage injection needs in Europe,as per the IEA's report. (Oil & Gas Journal)

Technically, the low from late April in January futures is 4.594--with the daily chart's lower bollinger band right there. Below that support is seen at 4.516. Upside resistance lies at 4.738-4.743. Momentum remains negative for the January futures basis its daily chart.

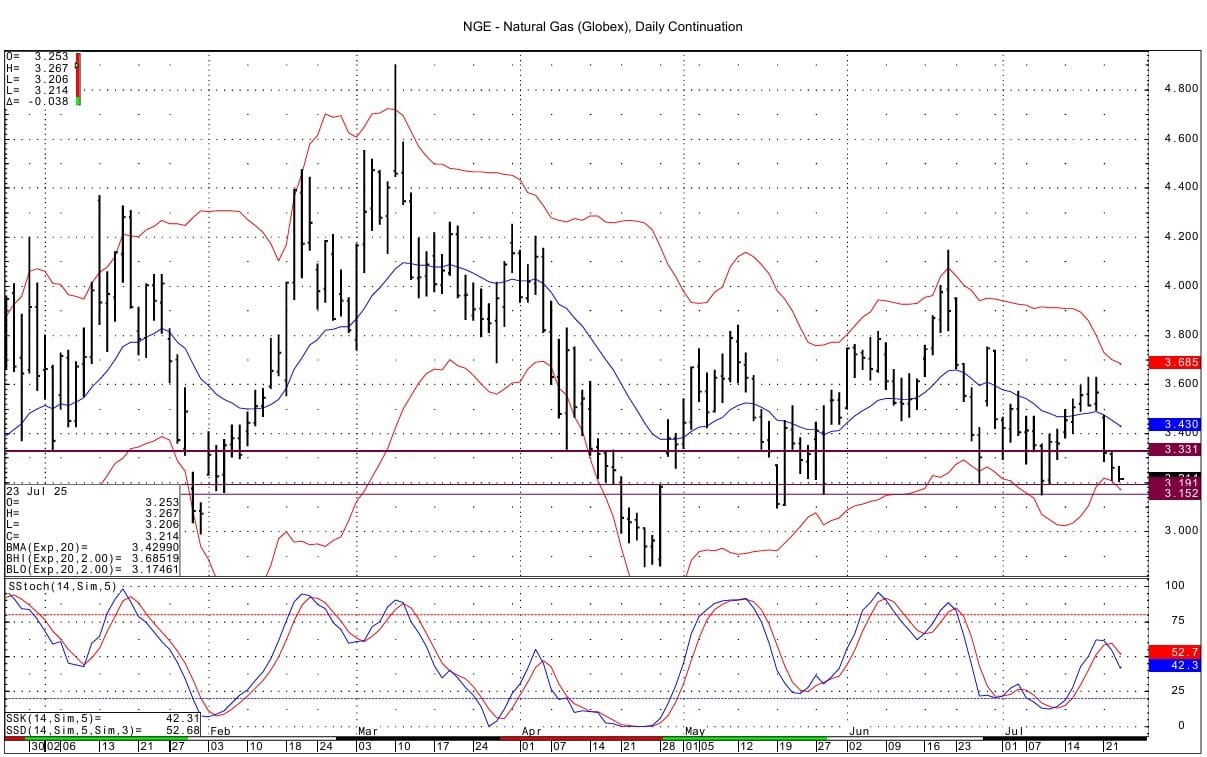

The August spot futures see support at 3.191 and then at 3.149-3.152. Resistance comes in at 3.331-3.334. Momentum remains negative.

Enjoyed this article?

Subscribe to never miss an issue. Daily updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply