- Liquidity Natural Gas Daily

- Posts

- Natural Gas Update July 24,2025

Natural Gas Update July 24,2025

Liquidity Energy, LLC

Overview

Natural Gas--September NG is up 5.4 cents

NG futures are higher now having traded overnight in a tight range. We suspect some bargain hunting and short covering are in effect currently. The market has lost over 13% in the prior 3 sessions as a cooler forecast into early August, record gas production and " stagnant gas flows to LNG export plants" have weighed on prices. The spot NG futures settled Wednesday at its lowest value since April 25.

The EIA storage data is expected to show an increase of 29-33 BCF as per news wire surveys. This compares to last year's build of 20 BCF and the 5 year average build of 30 BCF.

Despite intense Summer heat across the Central U.S., the natural gas powerburn continues to trail year-ago levels due gains in both coal & renewable (wind & solar) generation. Over the past week, the gas share of the powerstack is down a steep -7% vs 2024. (Celsius Energy) Meteorologists forecast the weather in the Lower 48 would remain mostly hotter than normal through at least August 7. The hottest days of the summer are expected early next week. (Reuters) NGI commentary adds : "the 2 week forecast is not so scary".

Lower 48 natural gas production averaged 108.33 BCF/d in the 10 days to July 22nd, compared to last week's 10-day average of 107.21 BCF/d. (Market News) LSEG said on Wednesday that average gas output in the Lower 48 U.S. states rose to 107.3 BCF/d so far in July. On July 9, LSEG said that July average output was 106.7 BCF/d.

LSEG forecast average gas demand in the Lower 48, including exports, will rise from 105.9 BCF/d this week to 110.1 BCF/d next week. These forecasts were down a total of 0.7 BCF/d from Monday's forecasts.

Based on the withdrawal rates from the last ten years, the EU storage level would build to an average of 86.9% of capacity at the end of October with a range between 76.7% and 95.2%.

European gas storage has been filling at a similar rate to that seen in the Summer of 2022, which if this continues could see European stores over 90% full by early October. (Market News) The notion of ample supply has seen the front month TTF futures fall to their lowest value since May 2nd.

But, Europe's gas market could tighten further ahead of the winter season as storage levels remain well below last year and the continent faces competition from Asia for LNG shipments, the CEO of Norway's Equinor told Reuters on July 23. "In June, we saw 25% less LNG ships into Europe compared to before, meaning that the competition tightens a little bit," he added. Equinor is Europe's largest natural gas provider.

Notable in LN options from Wednesday's open interest data is the large drop in the August $3.00 put strike. One sizable trade seen saw the $3.00 put sold versus buying of the $3.25 put at a cost of 15.1 cents with penultimate day futures bought at $3.07. The -$0.20 September October 1 month calendar spread put traded 2,500 contracts with the buyer paying 1.1 cent. One other notable trade seen was in the April October 6 month calendar put spread. Two of the -$0.75 puts was sold against buying of one -$.50 puts at a cost of 2.1 cents to the -$.50 put buyer. The April October CSO trades were opening positions basis CME open interest.

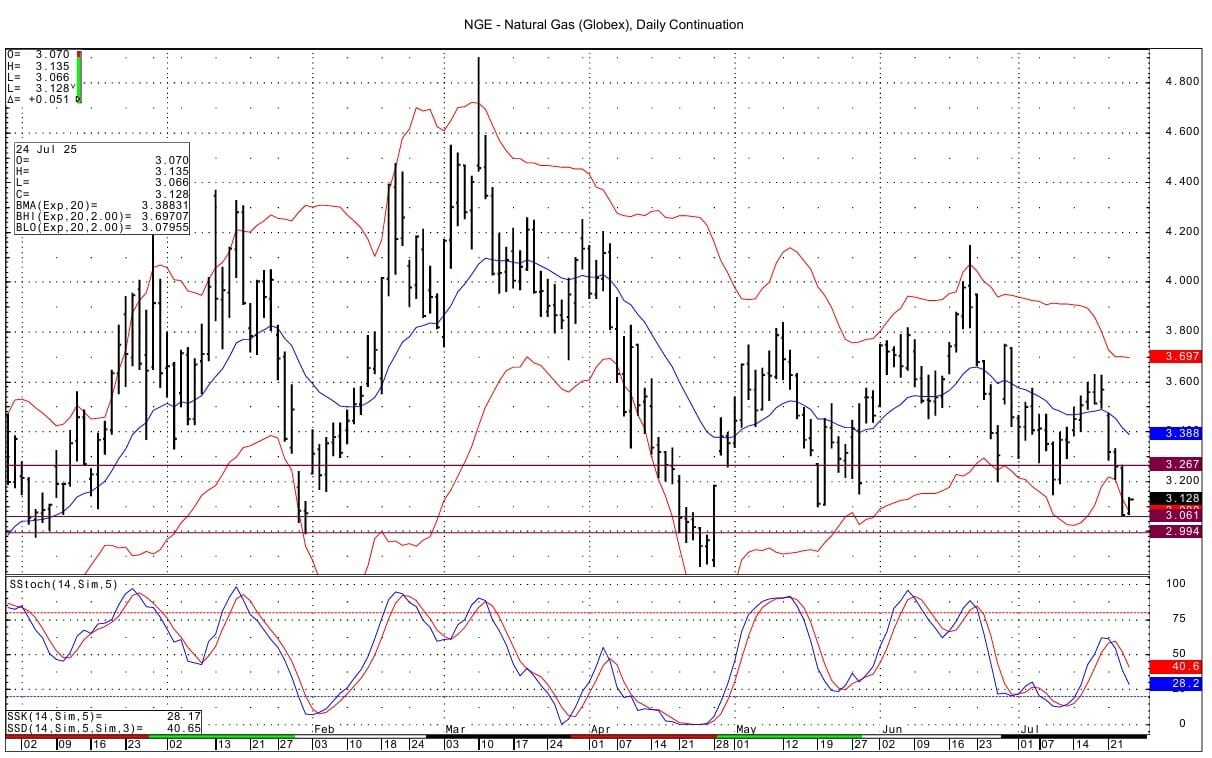

The September NG futures fell yesterday to their lowest value since November 15,2024. The September and daily continuation NG futures charts show mean reversions from Wednesday's close below their lower bollinger band. The September daily chart's band lies near 3.14. Momentum though remains negative for the September futures basis the daily chart. Support for September futures lies at 3.084-3.090. Resistance comes in at 3.299-3.307.

Enjoyed this article?

Subscribe to never miss an issue. Daily updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply