- Liquidity Natural Gas Daily

- Posts

- Natural Gas Update July 25,2025

Natural Gas Update July 25,2025

Liquidity Energy, LLC

Overview

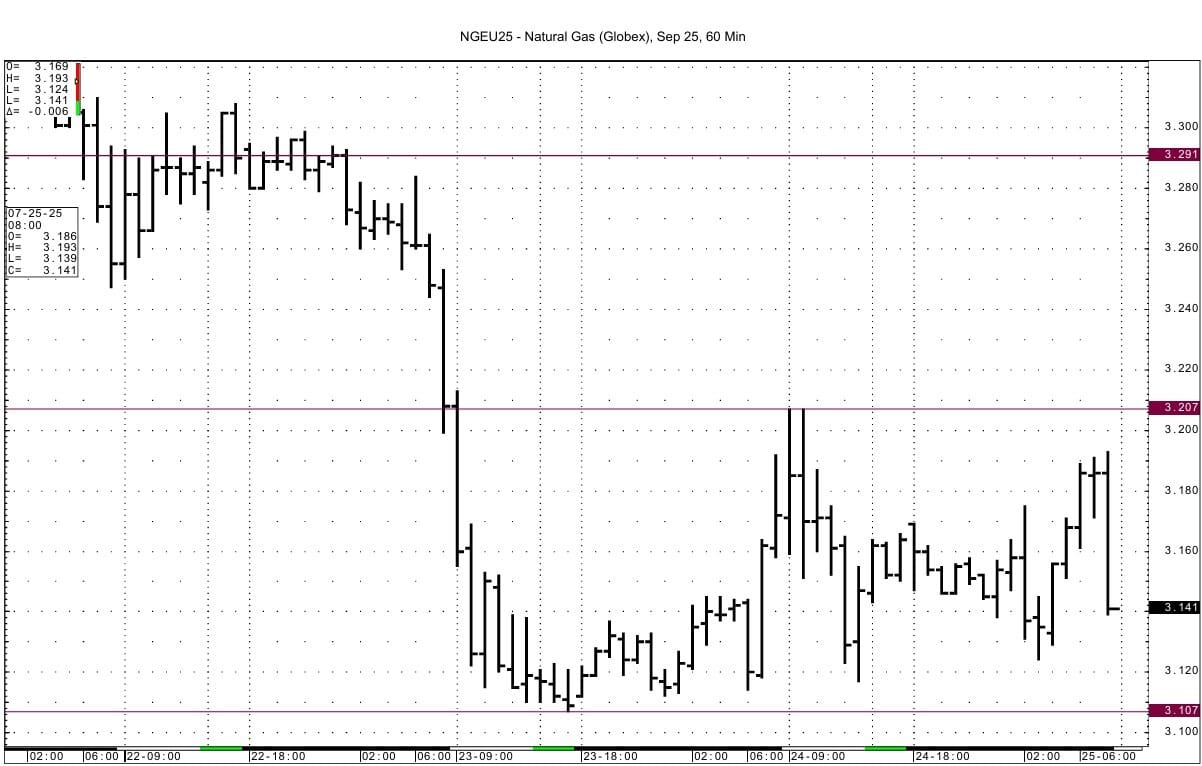

Natural Gas-- September NG is up 1 tick

NG futures are near unchanged now after rallying a bit overnight continuing the uptick seen Thursday off the back of a bullish EIA storage number and the forecasts for the hottest weather in three years to blanket much of the country early next week. (Reuters) Yet, despite the bullish EIA number and a better technical picture, some skepticism about the strength of the NG remains, or as one commentary reads: "sentiment remains cautious."

The EIA storage number was bullish with a build of 23 BCF, beating forecasts by 7 to 8 BCF. The immediate reaction to the data was a rise in very active volume to test the high for the day of 3.207 seen prior in the session. Total gas in storage rose to 3.075 TCF. That is +171 BCF/ +5.89% versus the 5 year average, but -153 BCF/-4.74% versus last year's level. The following comments were seen re the storage data : (1) " the smaller-than-expected build has so far not added any significant bullish sentiment back into the fray. Intense heat over the coming week should continue to limit storage builds for the next two reports, but a shift to a milder solution in the East near the end of the 10-day period should help to alleviate demand from there." (2) Balances were tighter in this bullish event, but "Expect it to be a one-off event as imbalances loosened considerably this week due to stronger wind generation. "

Yet, Celsius Energy cites that wind generation has weakened :"With wind generation fading and temperatures heating up across the Northeast, the natural gas powerburn demand has finally pulled above year-ago levels intraday. On a daily basis, however, burns will likely trail 2024 for at least one more day at around 47 BCF/day."

Some of the skepticism re the NG market's ability to rally and or strengthen could be evidenced by the weakness in the front month spread, that fell Thursday to a contract low, settling at a discount of 5.3 cents. Yet, we wish to ask if the strength of the September versus August is maybe being seen for 2 reasons. (1) is there long liquidation occurring in the August contract, which expires Tuesday? (2) is there some fresh buying happening in the September contract off the back of the supportive EIA number and the prospect for more heat next week ?

Technically the September NG futures had an inside day Thursday, having had a price range within the one seen Wednesday. There is a double bottom from Wednesday/Thursday at 3.107/3.112. Furthermore supportive for the September contract is the confirmation of the mean reversion setup from Wednesday, as Thursday the contract rose to settle over the lower bollinger band on the daily chart. That band today lies at about 3.100. But, momentum remains negative for the September futures basis the daily chart. September NG sees support at 3.084 below the double bottom at 3.107-3.112. Resistance lies at 3.207 and then at 3.284-3.291.

Enjoyed this article?

Subscribe to never miss an issue. Daily updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply