- Liquidity Natural Gas Daily

- Posts

- Natural Gas Update July 28,2025

Natural Gas Update July 28,2025

Liquidity Energy, LLC

Overview

Natural Gas --September NG is up 5 ticks, while August is down 9 ticks.

September NG futures are slightly higher now having fluctuated between higher and lower pricing overnight. Spot August futures are near unchanged. Strong NG production and a weaker natural gas powerburn are seen as weights on the August futures price. Is the lure of a close for August futures near $3 with the options expiring today also a weight on prices? September may be benefiting from the EU trade deal sentiment and the prospect for hotter weather in the 2nd week of August.

US domestic natural gas production is estimated today at 108.59 BCF/d. This compares to the previous 30 day average of 107.95 BCF/d, according to Bloomberg data.

The NG futures rally seen overnight was said to be due to GWDD's having been added in forecasts over the weekend and the 2nd week of August's weather is seen above average after a brief cooldown after the intense heat of the next 3 days-as per Celsius Energy commentary. Lower 48 natural gas demand is up 2.52 BCF/d today at 82.8 BCF/d today to remain near the highest since April, Bloomberg shows.

Shares of U.S. LNG developers surged in premarket trading on Monday, after the EU pledged to purchase $750 billion worth of the super-cooled fuel over the next three years as part of a sweeping trade pact. (Reuters)

Today is the last trading day for the August NG/LN options contract. The $3.00 put options have open interest of 26,405 contracts. The $3.25 strike has the largest open interest with a total between puts and calls of almost 40,000 contracts.

The natural gas rig count rose by 5 units to 122, their highest since August 2023, in the Baker Hughes report issued Friday. (Reuters)

CFTC data seen Friday shows money managers added to their net short total by mostly selling longs in the week ended Tuesday July 22. The total net short position rose by 10,514 contracts to 30, 039 contracts.

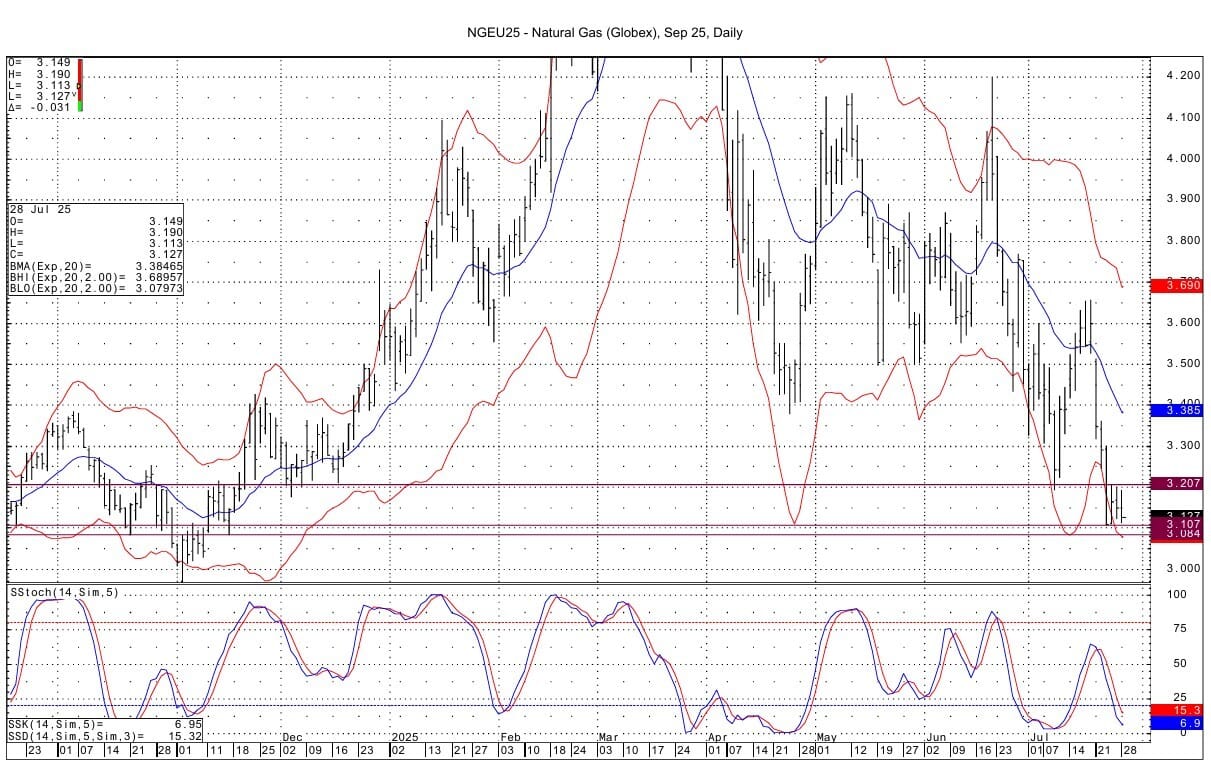

Technically, the spot NG futures have fallen to their lowest price ($3.047) seen since April 28. September NG futures, though, have as yet not fallen below the low seen last week of 3.107. Support below that is seen at 3.084-3.090. Resistance lies at 3.207 and then at 3.276-3.280.

Enjoyed this article?

Subscribe to never miss an issue. Daily updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply