- Liquidity Natural Gas Daily

- Posts

- Natural Gas Update July 30,2025

Natural Gas Update July 30,2025

Liquidity Energy, LLC

Overview

Natural Gas- NG is down 8.8 cents

September NG is lower now after rallying overnight as the prospect of continued strong natural gas production and some curtailment of Sabine LNG feed gas flow for LNG export are seen capping the upside. The rally seen yesterday and overnight are said to have been due to the expectation for a "gradual warm-up" next week. The better forecast looking forward is seen having sparked short covering. Some quantify the rally as having been due to a technical bounce.

NatGasWeather sees the following weather outlook:" "a hotter than normal pattern is expected to return over most of the U.S. for the 2nd week of August with highs of upper 80s to 100s, and where the weather pattern returns bullish." Forecaster Vaisala on Tuesday said that above-normal temperatures are forecast for the West and the East for the August 8-12 period, which will boost natural gas demand from electricity providers. (Barchart)

Total feedgas flows to US LNG export terminals are today estimated at 14.85 BCF/d, as Sabine has reduced its volume by nearly 0.5 BCF/d. Feedgas volume was at 15.04 BCF/d on Monday.

The EIA released the Annual Energy Outlook 2025 on Tuesday. In it, they project LNG exports rising to 27 BCF/d by 2037. They see 5 projects under construction entering service by 2028, making up 60% of the 2037 expected total. they see LNG exports remaining flat from the mid-2030's until 2050. But the EIA adds that "production in regions closest to the Gulf Coast decreases over the projection period." The mention that NG production in the Permian basin will fall as crude oil production there is seen falling. The Haynesville basin will see production declines as drilling costs there are more expensive. The EIA projects higher Gulf Coast NG prices, that will drive production increases in the Eastern portion of the U.S. to send gas southward. In the AEO2025 Reference case, the Henry Hub natural gas spot price increases to $4.80 in 2050, denominated in 2024 dollars, compared with $2.19 in 2024. In 2024, natural gas prices averaged $0.75/MMBtu more on the Gulf Coast than in the East region, indicating that resources in the East are more economical to produce even when including the costs to transport natural gas to consumers in Texas and Louisiana on the Gulf Coast.

The rally in gas futures came even as the forecasts we see for the EIA gas storage data to be released tomorrow are bearish versus the 5 year average. Gas storage is seen building by 39 to 48 BCF. The 5 year average build is 24 BCF.

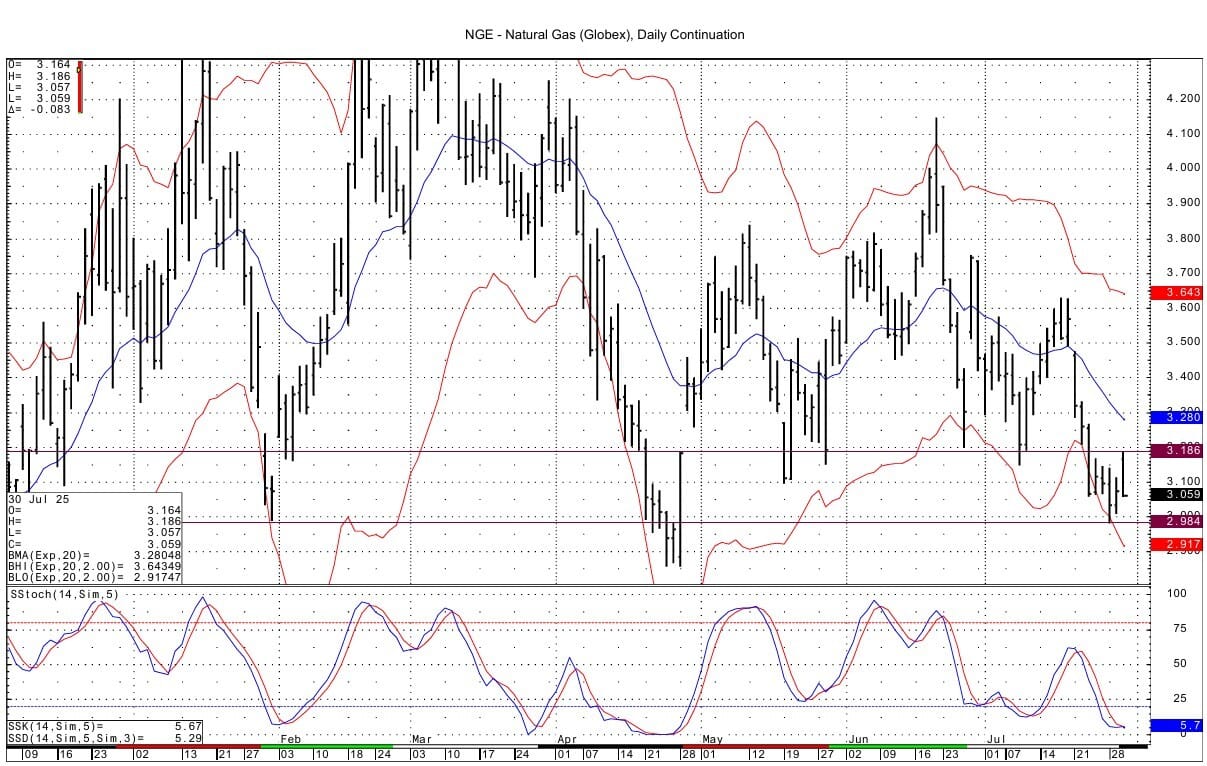

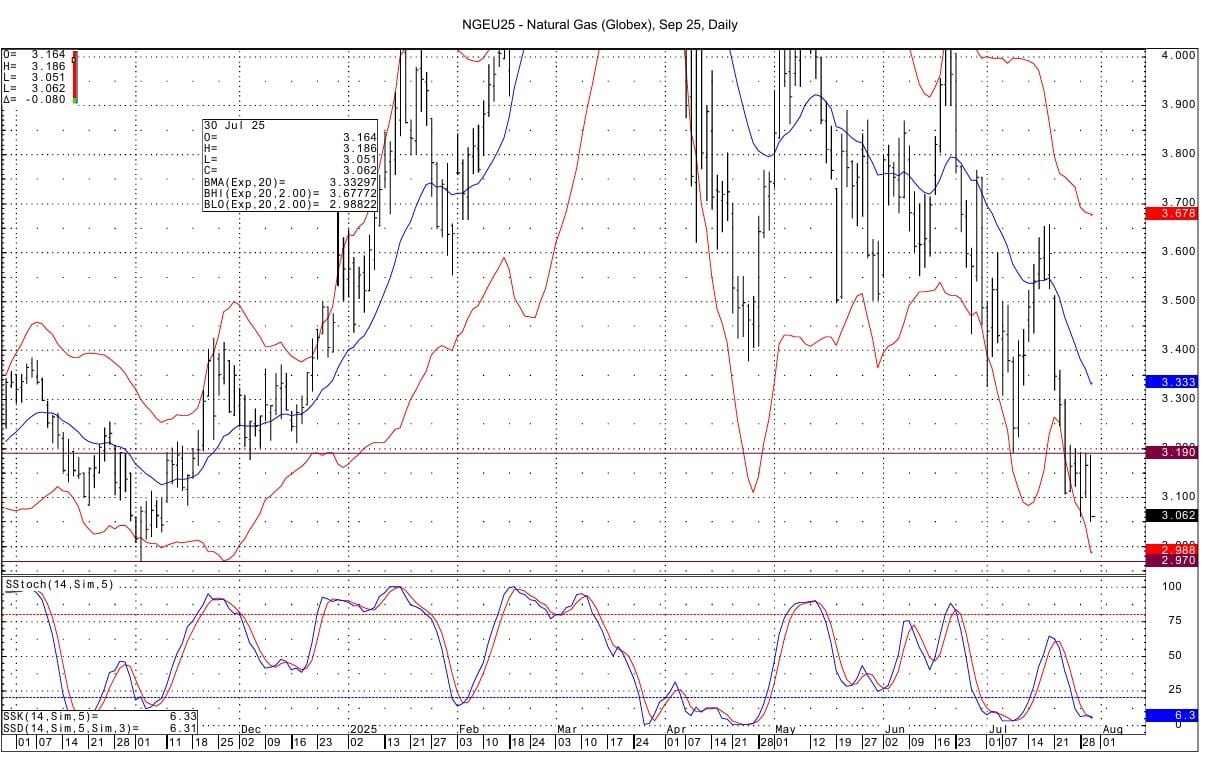

The momentum basis the DC chart is trying to turn positive with the turn now to September as the spot futures. Resistance for the September futures lies at the past 3 sessions' highs for September at 3.186-3.192. Support lies at the low seen for the August contract 2 days ago at 2.984. There is a major low from the September daily chart just below that at 2.970 from November of 2024.

Enjoyed this article?

Subscribe to never miss an issue. Daily updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply