- Liquidity Natural Gas Daily

- Posts

- Natural Gas Update July 7,2025

Natural Gas Update July 7,2025

Liquidity Energy, LLC

Overview

Natural Gas--NG is down 6.7 cents

Weather demand is not strong enough to support prices at present --with near normal weather. Last week's EIA storage data showing ample inventories is also likely weighing on prices.

Last Thursday's EIA gas storage data showed an increase of 55 BCF. Total storage rose to 2.953 TCF. That is +173 BCF/+6.22% versus the 5 year average, but -176BCF/-5.96% versus last year's level. Storage levels have now increased by a massive +1180 BCF for the storage injection season so far, 253 BCF bearish versus the 5-year average. (Celsius Energy) NGI commentary cites solar and coal generation taking away from gas power usage. Early estimates for this week's EIA gas storage number are calling for a build of 58 BCF. This compares to last year's build of 61 BCF and the 5 year average build of 53 BCF.

As an example of temperatures for the U.S. in the coming weeks, temperatures in the key Texas demand area are seen near to below average over the next 14 days. Houston will see temperatures from -4 to +2 degrees versus the monthly average. San Antonio temperatures will be -3/-6 degrees versus normal over the next 14 days, while Dallas will have temperatures -3/-8 degrees versus the monthly average. Chicago will have temperatures that are -3 to +4 degrees versus average over the next 14 days.

Activity in the natural gas and oil breadbasket of the country – across Texas, northern Louisiana and southern New Mexico – contracted during the second quarter, as business activity turned negative, according to a quarterly survey from the Federal Reserve Bank of Dallas. Energy activity in the region declined to minus 8.1 from a positive 3.8 in the first three months of this year. The Dallas Fed's survey of oil executives see the price for natural gas at $3.66 in 6 months, rising to $3.81 in a year. (NGI)

The Baker Hughes gas rig count issued last Thursday showed a decrease of 1 unit.

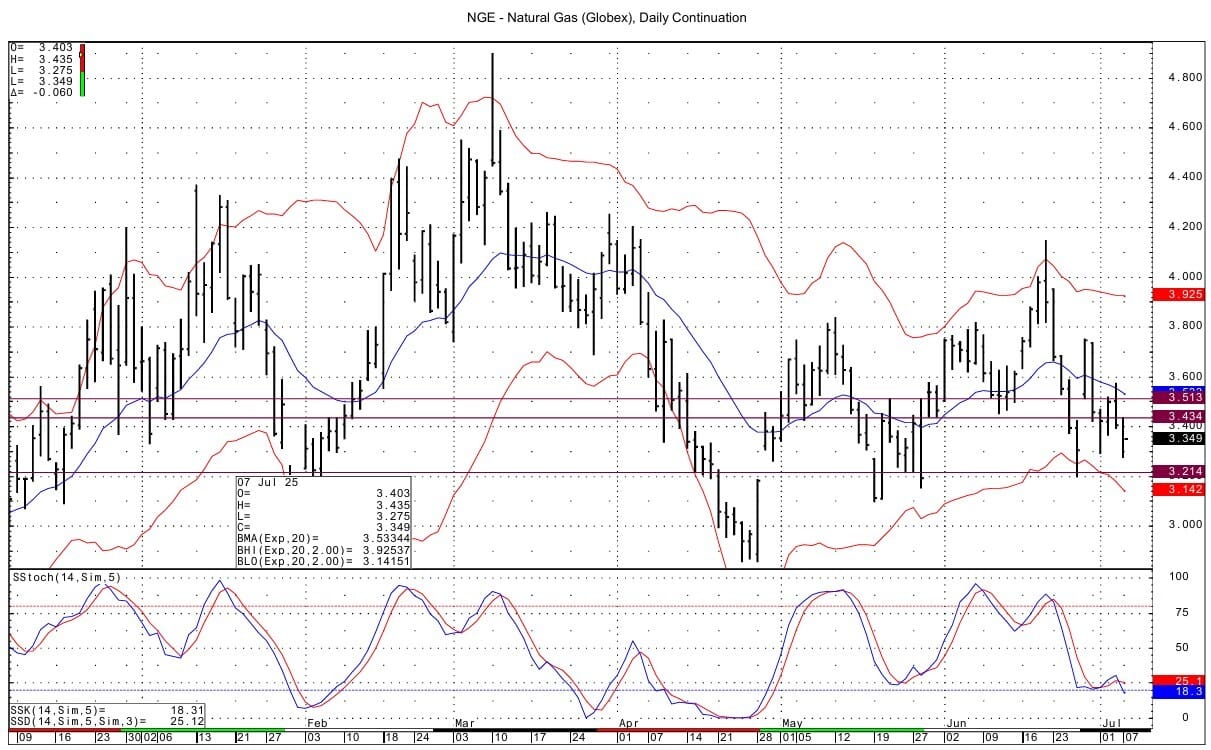

Technically NG spot futures have negative momentum basis the DC chart. Support below is seen at 3.214-3.217. Resistance comes in at the overnight high at 3.434-3.435 and then at 3.513-3.520.t and images here

Enjoyed this article?

Subscribe to never miss an issue. Daily updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

This Tiny Hearing Aid Is Changing Lives—And It’s Under $100

Big companies charge THOUSANDS for hearing aids—but guess what? You don’t have to pay that much.

Oricle Hearing gives you crystal-clear sound, wireless charging, and all-day battery life for under $100. No doctor visits, no crazy prices—just amazing hearing at an unbeatable deal.

Over 150,000 happy customers are already loving their new way of hearing. Don’t let overpriced hearing aids hold you back—order yours today.

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply