- Liquidity Natural Gas Daily

- Posts

- Natural Gas Update July 8,2025

Natural Gas Update July 8,2025

Liquidity Energy, LLC

February 3, 2026

Overview

Natural Gas--NG is up 0.6 cents

NG futures are slightly higher as weather forecasts have added some demand.

Forecaster Vaidsala said Monday that temperatures shifted warmer for the middle of the country from July 17 to 21. Celsius Energy adds that the 4 week period from June 28 to July 25 will see Gas Weighted Degree Days (GWDD's) 16% over the historical average. National demand will be "decently strong" the next five days with high temperatures across much of the U.S., NatGasWeather said yesterday. (WSJ)

The CFTC COT report issued Monday showed money managers reduced their net short position in options/futures in NG on the CME by 9,096 contracts to a total 51,629 contracts. The data was for the week ended Tuesday July 1.

NGI reporting regarding Monday's rally off the lows in NG futures suggested it was due to bargain buying, which "overshadowed robust supplies and murky demand outlooks." Celsius Energy cites robust production even as well completion activity and drilling have declined.

In early trading Monday, the Henry Hub next day cash price versus the spot futures differential was seen at about 13 cents. This was narrower than the roughly 18.5 cent differential seen last Thursday and the 26 cent differential seen last Monday. Thus, we wonder whether some of the futures rally seen Monday was due to the narrow differential to next day cash.

Natural gas-fired electricity generation declined in the opening half of 2025 for the first time since 2021, falling 1.8% year/year as higher prices and increased competition from other generation undercut demand. The slowdown for gas-fired electricity came as NGI’s Henry Hub spot prices surged 66% to an average $3.714/MMBtu in the first half, compared with $2.240 in the year-earlier period. (NGI)

Canadian natural gas prices are poised to jump nearly 60 per cent this year — marking the end of years-long discounts — as a new export terminal begins shipping to global markets, a new forecast from Deloitte Canada predicts. Producers are not drilling fast enough. At the current pace of drilling and investment, the report says it could take four to seven years for Canadian producers to meet demand from LNG export projects already underway. According to Deloitte, the Alberta benchmark price, known as AECO, is expected to hit an average of $2.20 per million BTUs in the second half of the year, up by close to 62 per cent over 2024 levels. The report expects another big jump next year, with average prices rising to $3.50 per million BTUs. But, Deloitte adds that if current production activity is maintained over the next 5 years, that prices could fall back to current levels then. (Financial Post)

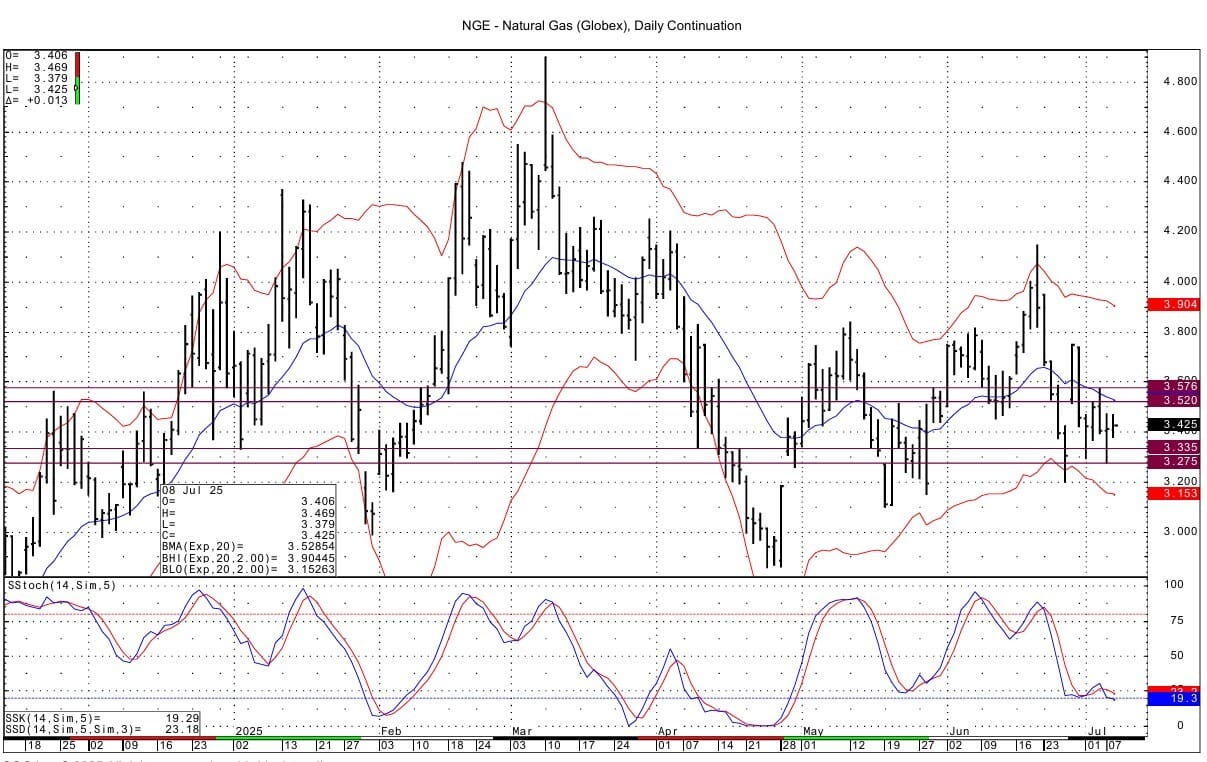

Technically, NG still has negative momentum basis the DC chart, but recent price action suggests more of a rangebound market with support having been found just below 3.30 and resistance lying up at 3.75. In the immediate, we see resistance at 3.513-3.520 and then at 3.574-3.576. There is currently a double top from yesterday/today in spot futures at 3.472/3.469. Support comes in at 3.335-3.340 and then at 3.275.

Enjoyed this article?

Subscribe to never miss an issue. Daily updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

This Tiny Hearing Aid Is Changing Lives—And It’s Under $100

Big companies charge THOUSANDS for hearing aids—but guess what? You don’t have to pay that much.

Oricle Hearing gives you crystal-clear sound, wireless charging, and all-day battery life for under $100. No doctor visits, no crazy prices—just amazing hearing at an unbeatable deal.

Over 150,000 happy customers are already loving their new way of hearing. Don’t let overpriced hearing aids hold you back—order yours today.

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply