- Liquidity Natural Gas Daily

- Posts

- Natural Gas Update November 17,2025

Natural Gas Update November 17,2025

Liquidity Energy, LLC

February 24, 2026

Overview

Natural Gas--- NG is down 14.0 cents at $4.426

NG futures prices are lower as near term weather forecasts turned milder over the weekend with many areas in the US to see above normal temperatures during the coming week. The bearish EIA data seen Friday and some long liquidation are said to have contributed to the sell off seen Friday.

Over the weekend, the near-term term temperature outlook trended milder for the November 19-26 period. (Celsius Energy) NatGasWeather reports that "much of the US warms above normal late in the week through next weekend." They see demand as light in the 4-12 day period then rising to moderate-to-high in the 13-15 day period.

The EIA storage data seen Friday showed a build of 45 BCF, which was 11 BCF more than news wires survey estimates. This seems to have been a function of an increase in production on the week of 1.6 BCF/d and a drop in demand of 0.7 BCF/d on the week, as per Market News data. One analyst adds : " mild temperature patterns expected for the remainder of November could bring further injections during the second half of the month, so we may not be at the official inventory peak just yet."

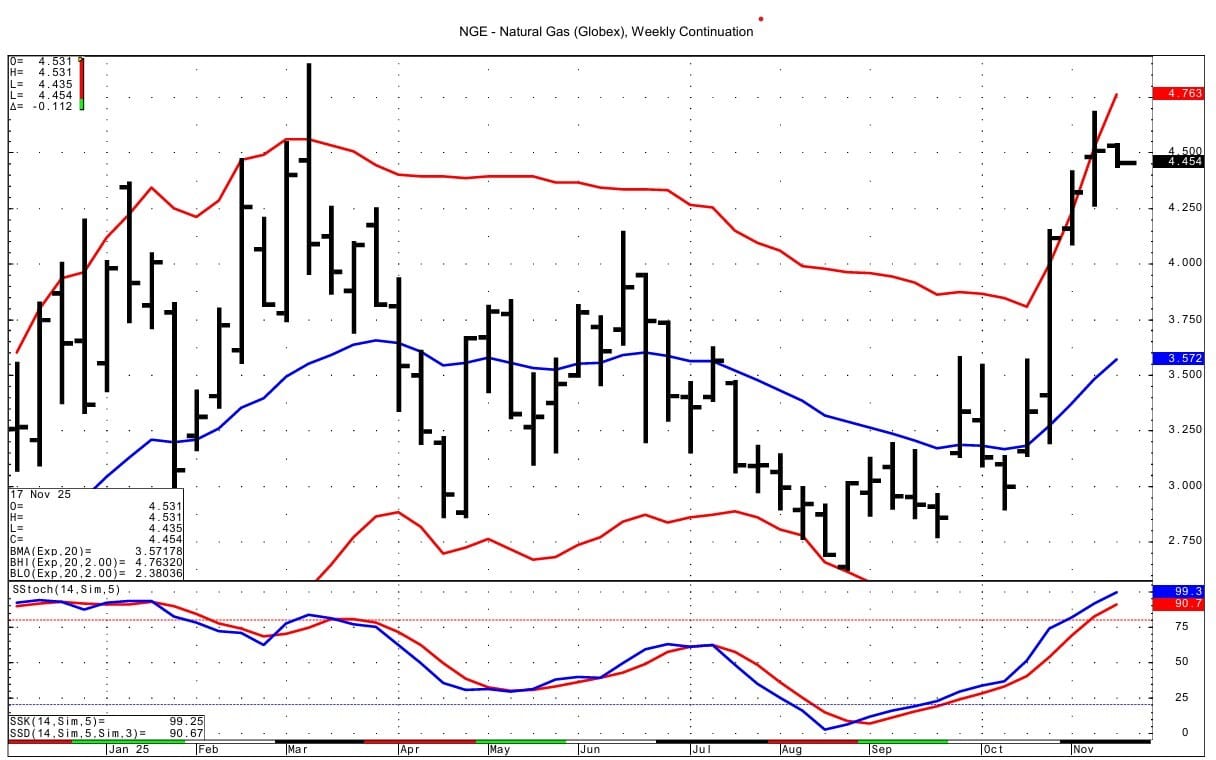

Technically the weekly NG continuation chart shows a mean reversion setup as the contract settled Friday over the upper bollinger band. That band lies currently at $4.76. Also, the stochastic momentum indicator basis the weekly chart is getting overbought. The DC chart shows momentum trying to turn downward from an overbought condition; yet, the spot futures are currently having an inside trading day versus Friday's price range.

Support for the spot futures is seen at the prior highs at 4.419-4.420, which has been tested this morning with a low of 4.409. Next support lies at 4.363-4.369. Resistance is seen at 4.550 and then at the recent highs at 4.581-4.582.

Enjoyed this article?

Subscribe to never miss an issue. Daily updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

The Gold standard for AI news

AI keeps coming up at work, but you still don't get it?

That's exactly why 1M+ professionals working at Google, Meta, and OpenAI read Superhuman AI daily.

Here's what you get:

Daily AI news that matters for your career - Filtered from 1000s of sources so you know what affects your industry.

Step-by-step tutorials you can use immediately - Real prompts and workflows that solve actual business problems.

New AI tools tested and reviewed - We try everything to deliver tools that drive real results.

All in just 3 minutes a day

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply