- Liquidity Natural Gas Daily

- Posts

- Natural Gas Update November 26,2025

Natural Gas Update November 26,2025

Liquidity Energy, LLC

February 3, 2026

Overview

Natural Gas ---NG is up 9.8 cents at $2.579

NG futures are higher today as January becomes the spot futures contract. Cold weather in the U.S. Midwest is seen supporting prices as is the continued record LNG feed gas volume.

January's futures price dipped on Tuesday to its lowest value since the beginning of the month on the back of record production and the belief that the U.S. natural gas storage level is ample. Tuesday's price weakness was also attributed to some profit taking, as per market commentary. Commentary suggested that the early morning weakness seen Tuesday was also a function of the Ukraine peace process news.

Worth noting in the December futures expiration is the value of the front end spread. The settlement for the December January spread was -5.7 cents. But, the best value seen traded on the CME for the spread was -7.5 cents and the last printed price was -8.5 cents. Even as the settlement was better than the actual prices traded, the spread still rose to its best value for the contract, which we see as a short-term supportive element as January becomes the spot futures contract.

Today's EIA storage data to be released at Noon (EST) is seen as a draw of 2 BCF as per Reuters and WSJ surveys. This compares to last year's draw of 2 BCF and the 5 year average draw of 25 BCF. The forecasts for today's data are a bit better than those seen earlier in the week when sources we saw had a build of 3 to 4 BCF.

LSEG shows November NG output so far running at 109.7 BCF/d, which is a record. The prior record was 108.3 BCF/d seen in August. On Monday, NG production was said to have hit a new record at 111.2 BCF/d as per LSEG data.

But, the record NG output is offset by the record amount of LNG feed gas. November LNG demand is so far seen at 18.0 BCF/d as per LSEG data, up from October's record of 16.6 BCF/d. Tuesday's LNG volume set a new record at 18.7 BCF/d. And the prospect going forward is for the LNG volume to increase, as the Golden Pass facility moves closer to processing its first LNG. The target date is seen as February for the facility that has a planned capacity of 2.0 BCF/d.

On Tuesday, LSEG projected average gas demand in the Lower 48 states, including exports, would rise from 122.0 BCF/d this week to 140.4 BCF/d next week. This week's demand figure is up by 3.9 BCF/d from the forecast seen last Thursday.

The European TTF contract has also stabilized today after yesterday falling to its lowest spot futures value since May 2,2024. The weakness seen yesterday was predominantly due to the prospect for peace in Ukraine, but a comment seen said :"the market is quite a long way away from seeing more Russian gas to Europe." Some of the drop in the TTF contract seen the past few sessions is also attributable to weakness in weather forecasts in the near term. "Next week, and very likely also the week after next week, will be milder than normal and especially in the western and northern parts of our area, while also windy and occasionally wet," as per a LSEG meteorologist. Gas demand for heating for northwest Europe is set to ease from 4,721 gigawatt hours (GWh) per day on Monday to 3,788 GWh/day (-24.6%) for working days next week, LSEG data showed. One analyst sees the downside as limited for gas prices in Europe. "Further downside is limited with current prices attractive for industrial buyers and falling European gas storage levels." European gas storage is 79.1% full, versus 88.3% a year ago, as per GIE data. (Reuters)

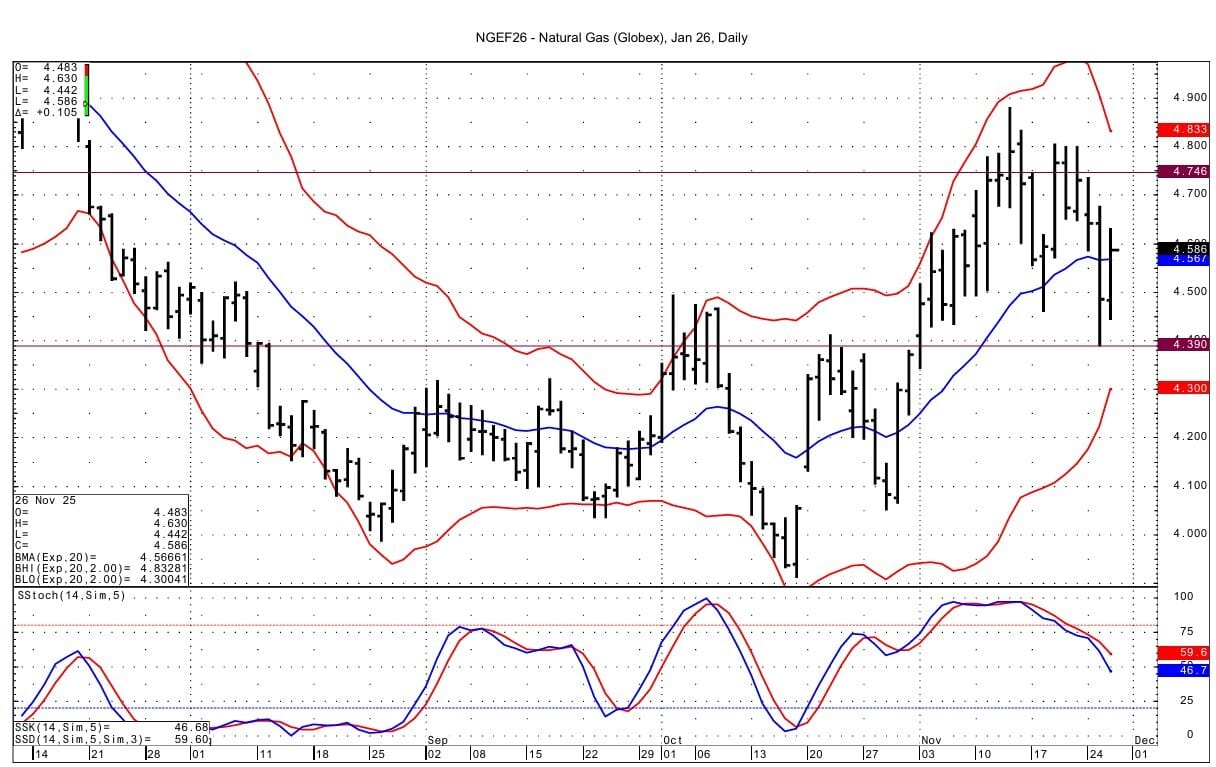

Technically momentum basis the NG DC chart is turning neutral as January becomes the spot futures, and the spot futures value thus get a small boost from the premium January had over December. DC chart based resistance comes in at 4.675-4.688. Above that resistance is seen at 4.736-4.746 from January's daily chart data. Support lies at the overnight low and December's low seen Monday at 4.442-4.444. Below this support comes in at 4.390-4.395.

Enjoyed this article?

Subscribe to never miss an issue. Daily updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply