- Liquidity Natural Gas Daily

- Posts

- Natural Gas Update November 28,2025

Natural Gas Update November 28,2025

Liquidity Energy, LLC

February 3, 2026

Overview

Natural Gas--NG is up 17.5 cents at $4.733

NG prices are at their highest spot futures price since March 10, supported by forecasts for cold weather and the continued record amount of LNG feed gas demand for export. On Wednesday, the EIA gas storage data showed a better than expected draw, although Wednesday's market reaction to the data was muted.

Celsius Energy says that LNG feedgas demand topped 19 BCF/day for the first time Wednesday and Thursday. This is up 5.6 BCF/d from year ago levels, they add. Market News reports that today's feedgas supply to US LNG export terminals is almost unchanged on the day at a record high of 18.89 BCF/d.

U.S. domestic natural gas production is estimated 0.559 BCF lower today after reaching another fresh high of 113.95 BCF/d yesterday, according to BNEF data.

Average Lower 48 temperatures are forecast below normal through the coming week but could rise back above normal into the second week of December, as per NOAA forecasts. The Midwest is seeing strong demand forecasts.

The EIA gas storage data seen Wednesday showed a better than expected draw of 11 BCF. This dropped total storage down to 3.935 TCF. This is 32 BCF (-0.81%) below year ago level. But, storage is +160 BCF (+4.24%) versus the 5 year average. Celsius Energy forecasts that the next 4 weeks total gas storage withdrawal will amount to 425 BCF. That would see the surplus to the 5 year average fall by 87 BCF; the large draw over the 4 weeks though will see the storage amount remain equal to last year's level, as per Celsius Energy's data analysis.

The Baker Hughes gas rig count issued Wednesday showed an increase of 3 units. But, the question is whether the large drop in the oil rig count will cause a drop in associated natural gas production over time.

Bloomberg data sees Chinese demand for LNG imports falling by 15% this year to 65 million tons. Next year's LNG import demand is seen at 73 million tons. Before the Ukraine conflict, Bloomberg had projected 2026 LNG imports rising to 100 million tons. Bloomberg sees this year's LNG import drop being a function of disappointing industrial demand coupled with "persistently" high global prices. The high cost of LNG has seen gas-fired power plants being faced with intense competition from coal and rapidly expanding renewables like solar and wind. Chinese LNG buyers, meanwhile, have more long-term supply contacts starting next year, But given that demand is deteriorating, they may choose to divert some fuel to places like Europe where prices are higher. This is likely to cement China’s role in balancing the global gas market, as companies there shift to becoming traders as well as consumers.

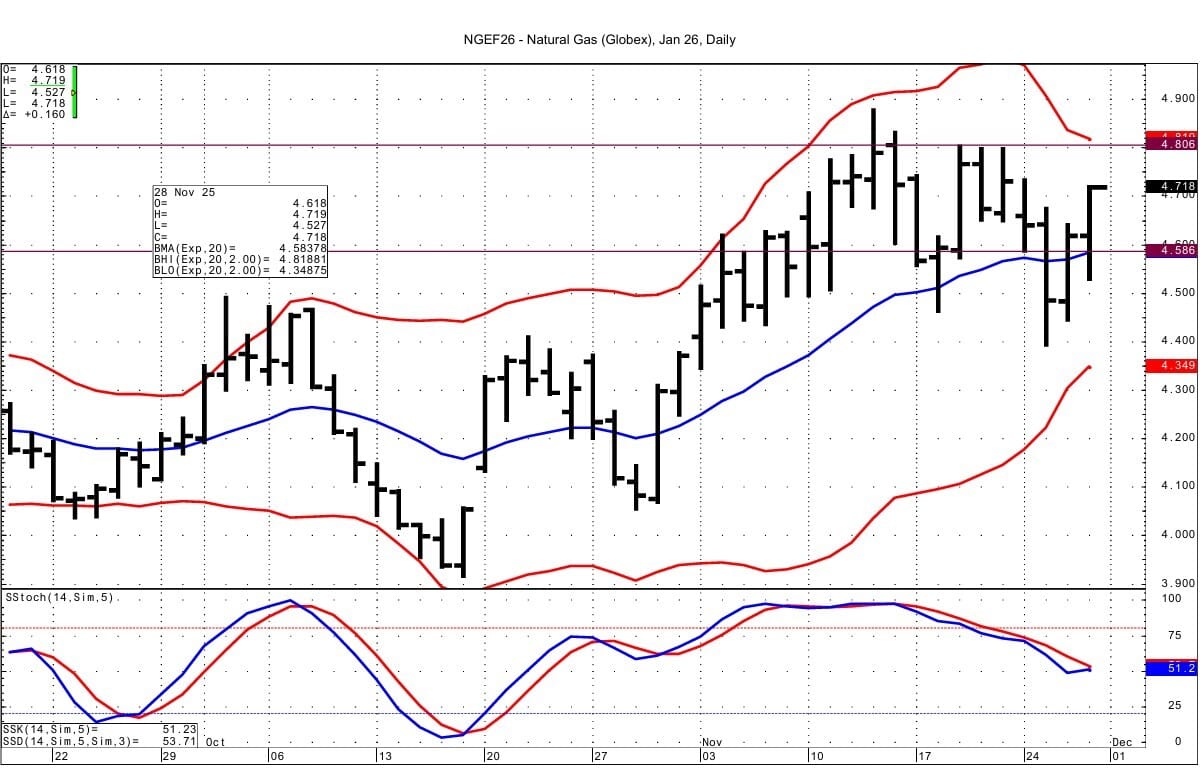

Technically momentum for the spot futures, basis the DC chart, has turned positive as the contract has risen over resistance seen at the high of 4.688 from 2 weeks ago. Next resistance is seen at 4.800-4.806 from January daily chart data. Support is likely at 4.585-4.586. 2 technical elements we see though give some pause to a bullish narrative. The spot futures are testing the DC chart's upper bollinger band that intersects at 4.690. Also the weekly NG chart has momentum that is overbought.

Enjoyed this article?

Subscribe to never miss an issue. Daily updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

The AI Insights Every Decision Maker Needs

You control budgets, manage pipelines, and make decisions, but you still have trouble keeping up with everything going on in AI. If that sounds like you, don’t worry, you’re not alone – and The Deep View is here to help.

This free, 5-minute-long daily newsletter covers everything you need to know about AI. The biggest developments, the most pressing issues, and how companies from Google and Meta to the hottest startups are using it to reshape their businesses… it’s all broken down for you each and every morning into easy-to-digest snippets.

If you want to up your AI knowledge and stay on the forefront of the industry, you can subscribe to The Deep View right here (it’s free!).

Reply