- Liquidity Natural Gas Daily

- Posts

- Natural Gas Update November 3,2025

Natural Gas Update November 3,2025

Liquidity Energy, LLC

Overview

Natural Gas --NG is up 5.3 cents at 4.177

NG spot futures are up today, having risen overnight to their best value since April 3rd, as feed gas demand hit a record over the weekend and weather forecasts turned cooler. The rise in NG futures pricing comes even as production is strong.

The weather forecast has added 13-17 HDD's. Parts of the U.S. are seen very cold on days 8 and 9 of the upcoming weather pattern. The Midwest & East will be 20-30 degrees below average.

Over the weekend, the LNG feed gas volume for export rose to a fresh record. On Saturday, LNG feedgas demand was said to have topped 18 BCF/d for the first time to a new record of 18.1 BCF/d, up a huge 6.3 BCF/d vs last year. There remains another approximately 1 BCF/d of demonstrated capacity not being utilized, according to Celsius Energy. On Sunday, though, some LNG volume was seen lost due to a problem at Freeport's facility, although news reports have operations restored to normal. Today's LNG feed gas volume is seen at 17.04 BCF/d, as per Bloomberg data, up from 16.4 BCF/d seen Sunday.

US domestic natural gas production is estimated down 0.966 BCF/d to 109.97 BCF/d today after rising to a record high of 110.94 BCF/d yesterday, according to Bloomberg data. On Friday, th EIA said that in August 2025, dry natural gas production increased year over year for the sixth straight month to a record 109.1 BCF/d. Production was 5.9% (6.0 BCF/d) higher in August 2025 than in August 2024 (103.1 BCF/d). The EIA added that gas consumption in August was down 3.0%/2.7 BCF/d year on year

The Baker Hughes gas rig count rose by 4 units in Friday's report.

Several options trades on the CME in Friday's activity caught our attention. Notably, the TTF options traded. The April through September Euro 30/25/20 put butterfly traded at a cost of 1.345 Euros, with .09 delta futures buys in the strip at Euro 29.75. Also the July, August, September Euro 30/25 put spread traded in a 1 by 2 ratio at a cost of 0.75 Euro. In the LN/NG options, the August $6/$7 call spread traded 6.75 cents with delta futures sales at $4.08. Also, in the Calendar Spread Options (CSO), the December/January -30/-40 cent put spread traded 2.0 and 2.1 cents. Also, in the CSO's, the February/March 25 cent put traded 8.5 cents.

TTF prices are up slightly today as the region’s gas reserves remain below last year’s levels, raising concerns about supply security. "According to industry group Gas Infrastructure Europe, European Union inventories are currently 82.8% full as the bloc heads into the colder season. The level is approximately 12% lower than last year and 8.2% below the seasonal norm, according to DNB. “There is now limited potential left for additional inventory builds as gas demand increases seasonally with lower temperatures,” analysts at the firm say. “Consequently, we head into the winter with significantly less storage flexibility than last year.” (WSJ)

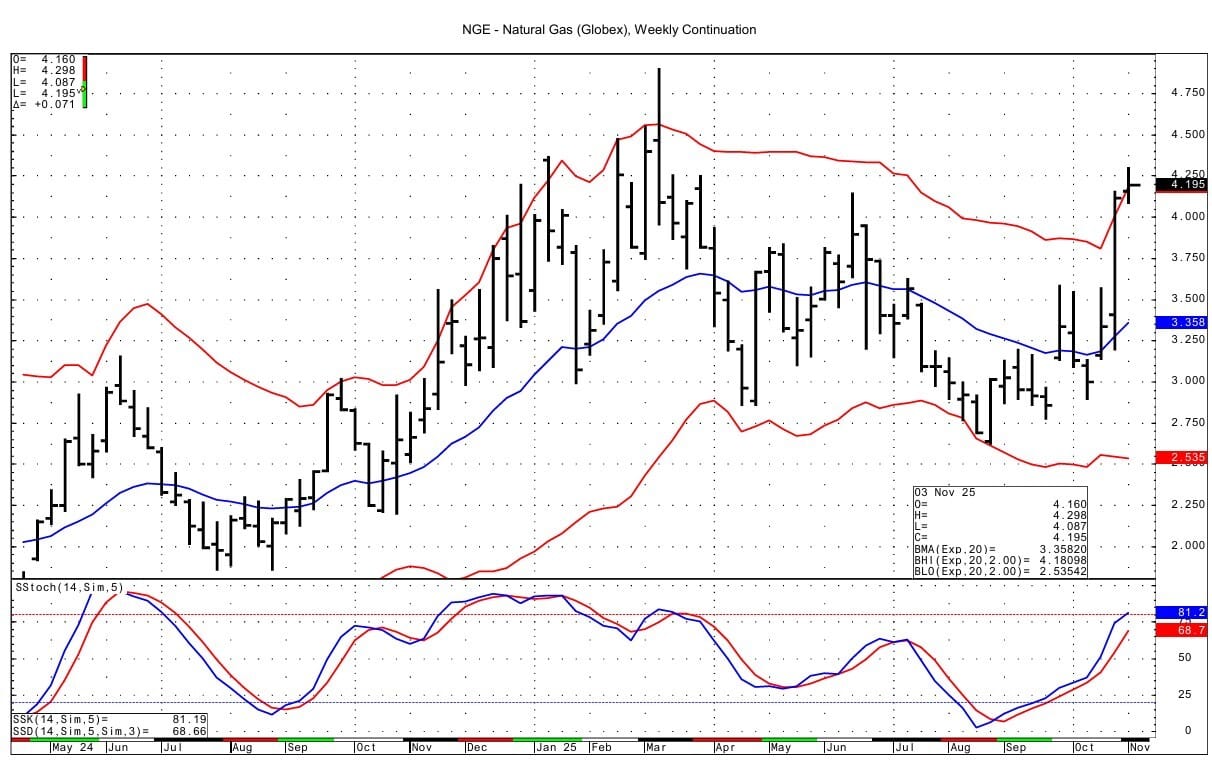

Technically, NG spot futures have again tested the upper bollinger band on the DC chart in today's session and have also tested the weekly chart's upper bollinger band. Reuters commentary from Friday re NG futures said that the contract was "technically overbought territory for a second day in a row for the first time in four weeks." They added :" For the week, the front-month was up about 25% after gaining 10% last week. That 25% gain would be its biggest weekly percentage gain since the contract rose by a record weekly percentage gain of around 33% in April 2024."

The DC chart upper bollinger intersects at 4.208 .The weekly upper bollinger band intersects at 4.180. Momentum basis both the DC and Weekly charts is positive and not yet overbought, though looks like it will be so in a day or 2 on the DC chart. Resistance for the spot futures comes in at 4.277-4.284, which was tested with the overnight high of 4.298. Above that resistance lies at 4.355.Support is seen at 4.103-4.109 and then at 4.045-4.046. The overnight low is 4.087.

Enjoyed this article?

Subscribe to never miss an issue. Daily updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply