- Liquidity Natural Gas Daily

- Posts

- NGZ5: Bullish Weekly Momentum Building – Watching for Daily Alignment

NGZ5: Bullish Weekly Momentum Building – Watching for Daily Alignment

Liquidity Energy, LLC

October 30,2025

Overview

NGZ5 – Bullish Technical Outlook

Weekly Chart Overview

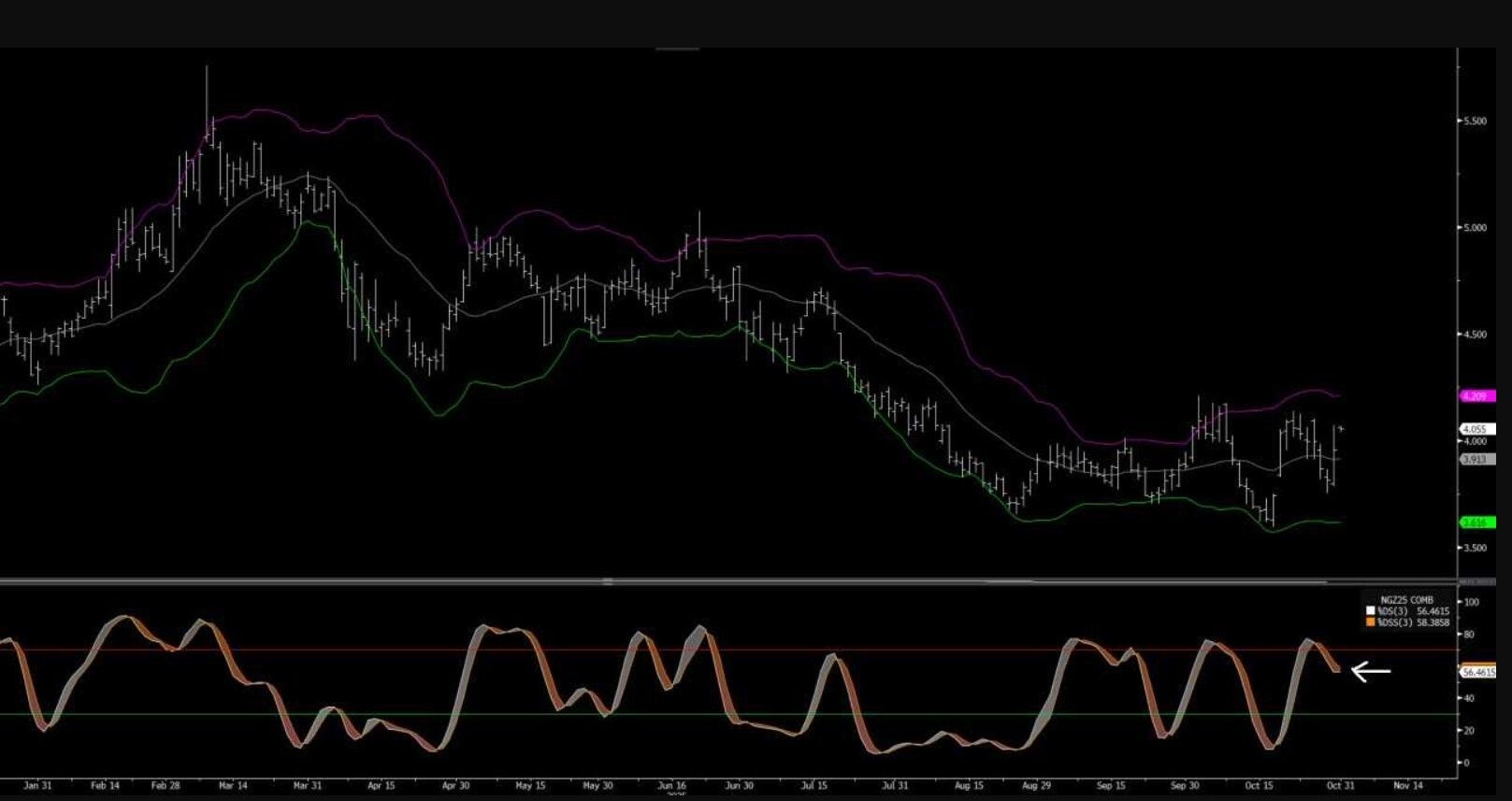

Three consecutive weekly closes below the lower Bollinger Band → followed by a sharp reversal higher at the end of August.

Two additional bullish reversal bars formed in September, confirming underlying strength.

Bullish weekly divergence noted on the new low in mid-October, signaling potential trend exhaustion on the downside.

Momentum continues to move higher, supporting the case for a medium-term bullish setup.

Daily Chart Overview

Range-bound price action since the end of July.

Expect sideways consolidation while overbought conditions work themselves out.

Ideally, a temporary impulsive move lower toward the lower Bollinger Band / bottom of the range could provide a buying opportunity.

Look for daily momentum to turn higher and align with bullish weekly momentum—this alignment could trigger a breakout to the upside.

Key Technical Levels

Topside Fibonacci Zones (retracement levels):

38.2% Fib: 4.421 → likely area for CTA stops.

50% Fib: 4.676

61.8% Fib: 4.931

Summary

Weekly structure and momentum are bullish.

Daily structure suggests near-term consolidation or a shallow pullback before the next leg higher.

Watch for momentum alignment across timeframes to confirm the next upside impulse toward the 4.42–4.93 zone.

Enjoyed this article?

Subscribe to never miss an issue. Daily updates provide a comprehensive analysis of both the fundamentals and technical factors driving energy markets.

Click below to view our other newsletters on our website:

Disclaimer

This article and its contents are provided for informational purposes only and are not intended as an offer or solicitation for the purchase or sale of any commodity, futures contract, option contract, or other transaction. Although any statements of fact have been obtained from and are based on sources that the Firm believes to be reliable, we do not guarantee their accuracy, and any such information may be incomplete or condensed.

Commodity trading involves risks, and you should fully understand those risks prior to trading. Liquidity Energy LLC and its affiliates assume no liability for the use of any information contained herein. Neither the information nor any opinion expressed shall be construed as an offer to buy or sell any futures or options on futures contracts. Information contained herein was obtained from sources believed to be reliable, but is not guaranteed as to its accuracy. Any opinions expressed herein are subject to change without notice, are that of the individual, and not necessarily the opinion of Liquidity Energy LLC

Reply